Solve Cournot oligopoly model via collocation

Contents

Solve Cournot oligopoly model via collocation¶

Randall Romero Aguilar, PhD

This demo is based on the original Matlab demo accompanying the Computational Economics and Finance 2001 textbook by Mario Miranda and Paul Fackler.

Original (Matlab) CompEcon file: demapp07.m

Running this file requires the Python version of CompEcon. This can be installed with pip by running

!pip install compecon --upgrade

Last updated: 2022-Oct-22

About¶

To illustrate implementation of the collocation method for implicit function problems, consider the example of Cournot oligopoly. In the standard microeconomic model of the firm, the firm maximizes profit by equating marginal revenue to marginal cost (MC). An oligopolistic firm, recognizing that its actions affect price, takes the marginal revenue to be \(p + q\frac{dp}{dq}\), where \(p\) is price, \(q\) is quantity produced, and \(\frac{dp}{dq}\) is the marginal impact of output on market price. The Cournot assumption is that the firm acts as if any change in its output will be unmatched by its competitors. This implies that

where \(D(p)\) is the market demand curve.

Suppose we wish to derive the effective supply function for the firm, which specifies the quantity \(q = S(p)\) it will supply at any price. The firm’s effective supply function is characterized by the functional equation

for all positive prices \(p\). In simple cases, this function can be found explicitly. However, in more complicated cases, no explicit solution exists.

Initial tasks¶

import numpy as np

import matplotlib.pyplot as plt

from compecon import BasisChebyshev, NLP

The model¶

Parameters¶

Here, the demand elasticity and the marginal cost function parameter are

alpha, eta = 1.0, 3.5

D = lambda p: p**(-eta)

Approximation structure¶

A degree-25 Chebychev basis on the interval [0.5, 3.0] is selected; also, the associated collocation nodes p are computed.

n, a, b = 25, 0.5, 2.0

S = BasisChebyshev(n, a, b, labels=['price'], y=np.ones(n))

p = S.nodes

S2 = BasisChebyshev(n, a, b, labels=['price'], l=['supply'])

S2.y = np.ones_like(p)

Residual function¶

Suppose, for example, that

Then the functional equation to be solved for S(p),

has no known closed-form solution.

def resid(c):

S.c = c # update interpolation coefficients

q = S(p) # compute quantity supplied at price nodes

marginal_income = p - q * (p ** (eta+1) / eta)

marginal_cost = alpha * np.sqrt(q) + q ** 2

return marginal_income - marginal_cost

Notice that resid only takes one argument. The other parameters (Q, p, eta, alpha) should be declared as such in the main script, were Python’s scoping rules will find them.

Solve for effective supply function¶

Class NLP defines nonlinear problems. It can be used to solve resid by Broyden’s method.

cournot = NLP(resid)

S.c = cournot.broyden(S.c, tol=1e-12)

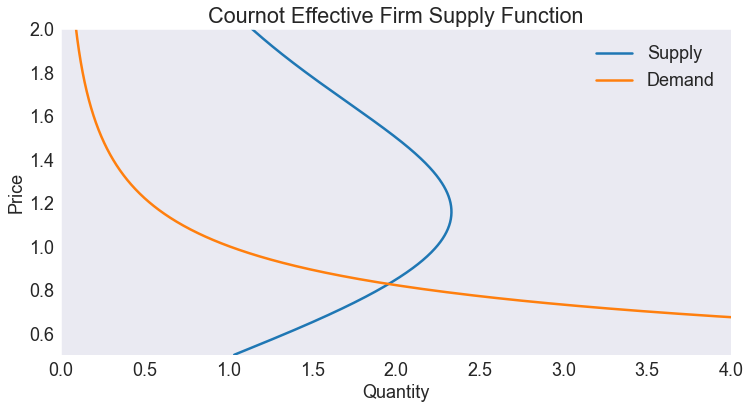

Plot demand and effective supply for m=5 firms¶

prices = np.linspace(a, b, 501)

fig1, ax = plt.subplots()

ax.plot(5 * S(prices), prices, label='Supply')

ax.plot(D(prices), prices, label='Demand')

ax.set(title='Cournot Effective Firm Supply Function',

xlabel='Quantity',

ylabel='Price',

xlim=[0, 4],

ylim=[0.5, 2])

ax.legend();

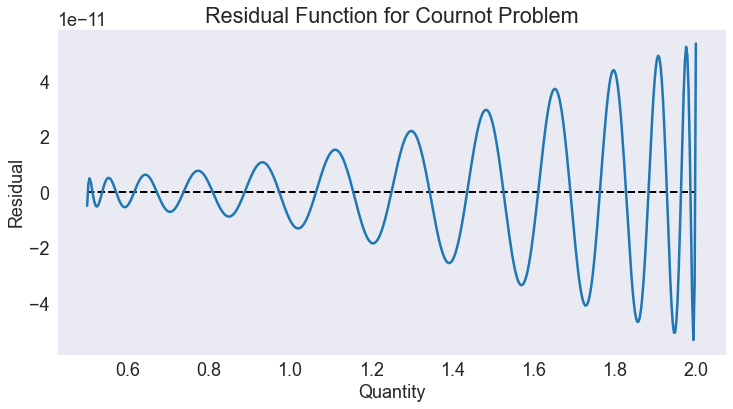

Plot residual¶

Notice that resid does not take explicit parameters, so to evaluate it when prices are prices we need to assign p = prices.

In order to assess the quality of the approximation, one plots the residual function over the approximation domain. Here, the residual function is plotted by computing the residual at a refined grid of 501 equally spaced points.

p = prices

fig2, ax = plt.subplots()

ax.hlines(0, a, b, 'k', '--', lw=2)

ax.plot(prices, resid(S.c))

ax.set(title='Residual Function for Cournot Problem',

xlabel='Quantity',

ylabel='Residual');

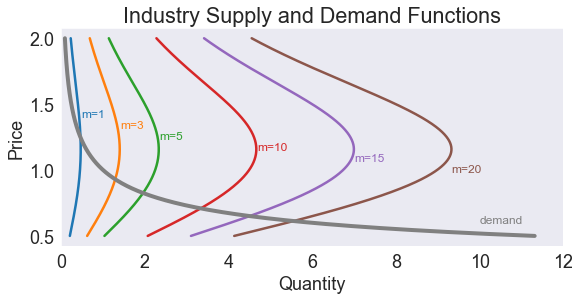

Plot demand and effective supply for m=1, 3, 5, 10, 15, 20 firms¶

fig3, ax = plt.subplots(figsize=[9,4])

ax.set(title='Industry Supply and Demand Functions',

xlabel='Quantity',

ylabel='Price',

xlim=[0, 12])

lcolor = [z['color'] for z in plt.rcParams['axes.prop_cycle']]

for i, m in enumerate([1, 3, 5, 10, 15, 20]):

ax.plot(m*S(prices), prices) # supply

ax.annotate(f'm={m:d}', [m*S(1.2)+.025, 1.4-i/12], color=lcolor[i], fontsize=12)

ax.plot(D(prices), prices, linewidth=4, color='grey') # demand

ax.annotate('demand', [10, 0.6], color='grey', fontsize=12);

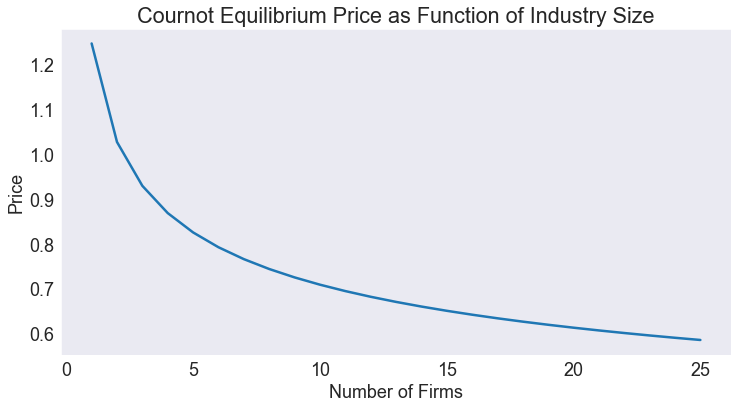

Plot equilibrium price as a function of number of firms m¶

m = np.arange(1,26)

x0 = np.full_like(m, 0.7, dtype=float) #initial guess

eqprices = NLP(lambda p: m*S(p) - D(p)).broyden(x0)

fig4, ax = plt.subplots()

ax.set(title='Cournot Equilibrium Price as Function of Industry Size',

xlabel='Number of Firms',

ylabel='Price')

ax.plot(m, eqprices);