Asset Replacement Model

Contents

Asset Replacement Model¶

Randall Romero Aguilar, PhD

This demo is based on the original Matlab demo accompanying the Computational Economics and Finance 2001 textbook by Mario Miranda and Paul Fackler.

Original (Matlab) CompEcon file: demdp02.m

Running this file requires the Python version of CompEcon. This can be installed with pip by running

!pip install compecon --upgrade

Last updated: 2022-Oct-22

About¶

Profit-maximizing entrepreneur must decide when to replace an aging asset.

import numpy as np

import matplotlib.pyplot as plt

from compecon import BasisSpline, DPmodel, qnwnorm, NLP

Model Parameters¶

The maximum age of the asset is \(A=6\), production function coefficients are \(\alpha =[50.0, -2.5, -2.5]\), net replacement cost is \(\kappa = 40\), long-run mean unit profit is \(\bar{p} = 1\), the unit profit autoregression coefficient is \(\gamma = 0.5\), the standard deviation of unit profit shock is \(\sigma = 0.15\), and the discount factor is \(\delta = 0.9\).

A = 6

ɑ = np.array([50, -2.5, -2.5])

κ = 40

pbar= 1.0

ɣ = 0.5

σ = 0.15

δ = 0.9

State space¶

The state variables are the current unit profit \(p\) (continuous) and the age of asset \(a\in\{1,2,\dots,A\}\).

dstates = [f'a={age+1:d}' for age in range(A)]

print('Discrete states are :', dstates)

Discrete states are : ['a=1', 'a=2', 'a=3', 'a=4', 'a=5', 'a=6']

Here, we approximate the unit profit with a cubic spline basis of \(n=200\) nodes, over the interval \(p\in[0,2]\).

n = 200

pmin, pmax = 0.0, 2.0

basis = BasisSpline(n, pmin, pmax, labels=['unit profit'])

Action space¶

There is only one choice variable \(j\): whether to keep(0) or replace(1) the asset.

options = ['keep', 'replace']

Reward Function¶

The instant profit depends on the asset age and whether it is replaced. An asset of age \(a=A\) must be replaced. If the asset is replaced, the profit is \(50p\) minus the cost of replacement \(\kappa\); otherwise the profit depends on the age of the asset, \((\alpha_0 + \alpha_1 a + \alpha_2 a^2)p\).

def profit(p, x, i, j):

a = i + 1

if j or a == A:

return p * 50 - κ

else:

return p * (ɑ[0] + ɑ[1]*a + ɑ[2]*a**2 )

State Transition Function¶

The unit profit \(p\) follows a Markov Process

where \(\epsilon \sim N(0,\sigma^2)\).

def transition(p, x, i, j, in_, e):

return pbar + ɣ * (p - pbar) + e

The continuous shock must be discretized. Here we use Gauss-Legendre quadrature to obtain nodes and weights defining a discrete distribution that matches the first 10 moments of the Normal distribution (this is achieved with \(m=5\) nodes and weights).

m = 5

e, w = qnwnorm(m,0,σ**2)

On the other hand, the age of the asset is deterministic: if it is replaced now it will be new (\(a=0\)) next period; otherwise its age will be \(a+1\) next period if current age is \(a\).

h = np.zeros((2, A),int)

h[0, :-1] = np.arange(1, A)

Model Structure¶

model = DPmodel(basis, profit, transition,

i=dstates,

j=options,

discount=δ, e=e, w=w, h=h)

SOLUTION¶

The solve method returns a pandas DataFrame.

S = model.solve()

S.head()

Solving infinite-horizon model collocation equation by Newton's method

iter change time

------------------------------

0 3.7e+02 0.1952

1 4.3e+01 0.5473

2 1.2e+01 1.1229

3 5.7e-01 1.6491

4 4.5e-13 2.0834

Elapsed Time = 2.08 Seconds

| unit profit | i | value | resid | j* | value[keep] | value[replace] | ||

|---|---|---|---|---|---|---|---|---|

| unit profit | ||||||||

| a=1 | 0.000000 | 0.000000 | 0 | 234.982583 | -5.684342e-14 | keep | 234.982583 | 206.124123 |

| 0.001001 | 0.001001 | 0 | 235.058576 | -6.159590e-07 | keep | 235.058576 | 206.209036 | |

| 0.002001 | 0.002001 | 0 | 235.134563 | -6.366804e-07 | keep | 235.134563 | 206.293949 | |

| 0.003002 | 0.003002 | 0 | 235.210544 | -2.317537e-07 | keep | 235.210544 | 206.378862 | |

| 0.004002 | 0.004002 | 0 | 235.286520 | 4.292312e-07 | keep | 235.286520 | 206.463774 |

Analysis¶

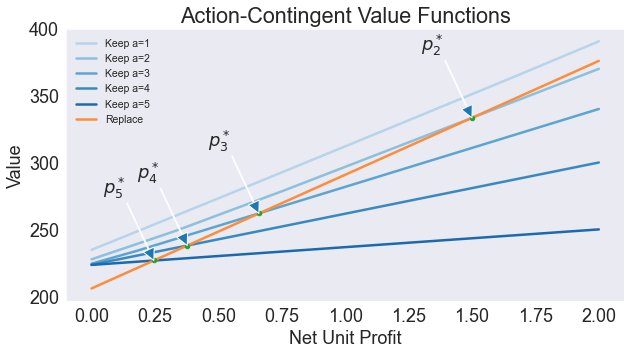

Plot Action-Contingent Value Functions¶

# Compute and Plot Critical Unit Profit Contributions

pcrit = [NLP(lambda s: model.Value_j(s)[i].dot([1,-1])).broyden(0.0) for i in range(A-1)]

vcrit = [model.Value(s)[i] for i, s in enumerate(pcrit)]

fig1, ax = plt.subplots(figsize=[10,5])

ax.set(title='Action-Contingent Value Functions', xlabel='Net Unit Profit',ylabel='Value')

cc = np.linspace(0.3,0.9,model.dims.ni)

for a, i in enumerate(dstates[:-1]):

ax.plot(S.loc[i,'value[keep]'] ,color=plt.cm.Blues(cc[a]), label=f'Keep {i}')

ax.plot(S.loc['a=1','value[replace]'], color=plt.cm.Oranges(0.5),label='Replace')

for a, i in enumerate(dstates[:-1]):

if pmin < pcrit[a] < pmax:

ax.plot(pcrit[a], vcrit[a], color='C2', marker='.', markersize=9)

ax.annotate(f'$p^*_{a+1}$', (pcrit[a], vcrit[a]), xytext=(pcrit[a]-0.2, vcrit[a]+50), arrowprops=dict(width=1))

print(f'Age {a+1:d} Profit {pcrit[a]:5.2f}')

ax.legend(fontsize="xx-small")

Age 2 Profit 1.50

Age 3 Profit 0.66

Age 4 Profit 0.38

Age 5 Profit 0.25

<matplotlib.legend.Legend at 0x13462c93d00>

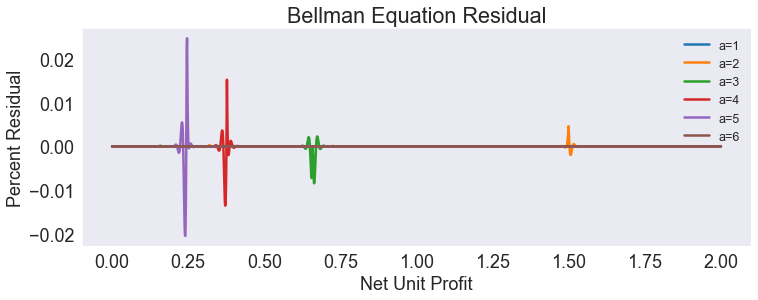

Plot Residual¶

fig, ax = plt.subplots(1,1, figsize=[12,4])

S['resid2'] = 100*S['resid'] / S['value']

S['resid2'].unstack(level=0).plot(ax=ax)

ax.set(title='Bellman Equation Residual',

xlabel='Net Unit Profit',

ylabel='Percent Residual')

ax.legend(fontsize="x-small")

<matplotlib.legend.Legend at 0x13462e22130>

SIMULATION¶

T = 50

nrep = 10000

sinit = np.full(nrep, pbar)

iinit = 0

data = model.simulate(T,sinit,iinit, seed=945)

data['age'] = data.i.cat.codes + 1

Print Ergodic Moments¶

frm = '\t{:<10s} = {:5.2f}'

print('\nErgodic Means')

print(frm.format('Price', data['unit profit'].mean()))

print(frm.format('Age', data['age'].mean()))

print('\nErgodic Standard Deviations')

print(frm.format('Price', data['unit profit'].std()))

print(frm.format('Age', data['age'].std()))

Ergodic Means

Price = 1.00

Age = 2.01

Ergodic Standard Deviations

Price = 0.17

Age = 0.83

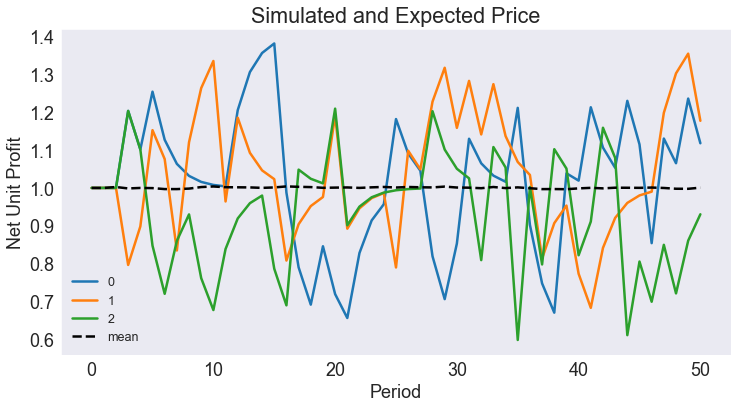

Plot Simulated and Expected Continuous State Path¶

data.head()

| time | _rep | i | unit profit | j* | age | |

|---|---|---|---|---|---|---|

| 0 | 0 | 0 | a=1 | 1.0 | keep | 1 |

| 1 | 0 | 1 | a=1 | 1.0 | keep | 1 |

| 2 | 0 | 2 | a=1 | 1.0 | keep | 1 |

| 3 | 0 | 3 | a=1 | 1.0 | keep | 1 |

| 4 | 0 | 4 | a=1 | 1.0 | keep | 1 |

subdata = data.query('_rep < 3').set_index(['time','_rep']).unstack()

subdata.head()

| i | unit profit | j* | age | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| _rep | 0 | 1 | 2 | 0 | 1 | 2 | 0 | 1 | 2 | 0 | 1 | 2 |

| time | ||||||||||||

| 0 | a=1 | a=1 | a=1 | 1.000000 | 1.000000 | 1.000000 | keep | keep | keep | 1 | 1 | 1 |

| 1 | a=2 | a=2 | a=2 | 1.000000 | 1.000000 | 1.000000 | keep | keep | keep | 2 | 2 | 2 |

| 2 | a=3 | a=3 | a=3 | 1.000000 | 1.000000 | 1.000000 | replace | replace | replace | 3 | 3 | 3 |

| 3 | a=1 | a=1 | a=1 | 1.203344 | 0.796656 | 1.203344 | keep | keep | keep | 1 | 1 | 1 |

| 4 | a=2 | a=2 | a=2 | 1.101672 | 0.898328 | 1.101672 | keep | keep | keep | 2 | 2 | 2 |

fig3, ax = plt.subplots()

subdata['unit profit'].plot(ax=ax, legend=None)

ax.set(title='Simulated and Expected Price', xlabel='Period',ylabel='Net Unit Profit')

ax.plot(data[['time','unit profit']].groupby('time').mean(),'k--',label='mean')

ax.legend(fontsize="x-small")

<matplotlib.legend.Legend at 0x13462e96550>

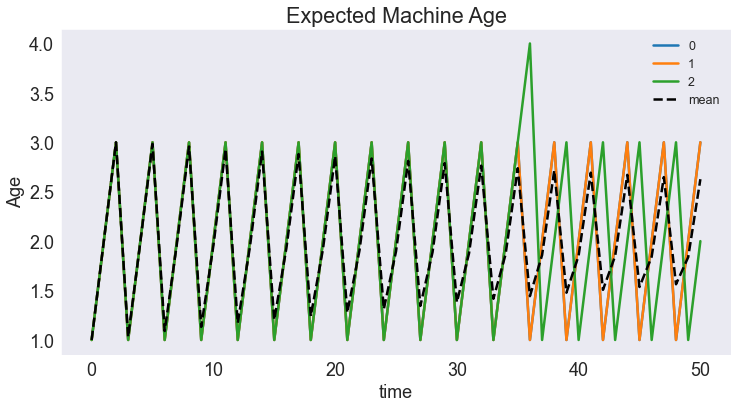

Plot Expected Discrete State Path¶

fig4, ax = plt.subplots()

ax.set(title='Expected Machine Age', xlabel='Period', ylabel='Age')

subdata['age'].plot(ax=ax, legend=None)

ax.plot(data[['time','age']].groupby('time').mean(),'k--',label='mean')

ax.legend(fontsize="x-small")

<matplotlib.legend.Legend at 0x13462f65be0>