Asset replacement model with maintenance

Contents

Asset replacement model with maintenance¶

Randall Romero Aguilar, PhD

This demo is based on the original Matlab demo accompanying the Computational Economics and Finance 2001 textbook by Mario Miranda and Paul Fackler.

Original (Matlab) CompEcon file: demddp03.m

Running this file requires the Python version of CompEcon. This can be installed with pip by running

!pip install compecon --upgrade

Last updated: 2021-Oct-01

About¶

Consider the preceding example, but suppose that the productivity of the asset may be enhanced by performing annual service maintenance. Specifically, at the beginning of each year, a manufacturer must decide whether to replace the asset with a new one or, if he elects to keep the asset, whether to service it. An asset that is \(a\) years old and has been serviced \(s\) times yields a profit contribution \(p(a, s)\) up to an age of \(n\) years, at which point the asset becomes unsafe and must be replaced by law. The cost of a new asset is \(c\), and the cost of servicing an asset is \(k\). What replacement-maintenance policy maximizes profits?

Initial tasks¶

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from compecon import DDPmodel, gridmake, getindex

Model Parameters¶

Assume a maximum asset age of 5 years, asset replacement cost \(c = 75\), cost of servicing \(k = 10\), and annual discount factor \(\delta = 0.9\).

maxage = 5

repcost = 75

mancost = 10

delta = 0.9

State Space¶

This is an infinite horizon, deterministic model with time \(t\) measured in years. The state variables

\(a \in \{1, 2, 3, \dots, n\}\)

\(s \in \{0, 1, 2, \dots, n − 1\}\)

are the age of the asset in years and the number of servicings it has undergone, respectively.

s1 = np.arange(1, 1 + maxage) # asset age

s2 = s1 - 1 # servicings

S = gridmake(s1,s2) # combined state grid

S1, S2 = S

n = S1.size # total number of states

Here, the set of possible asset ages and servicings are generated individually, and then a two-dimensional state grid is constructed by forming their Cartesian product using the CompEcon routine gridmake.

Action Space¶

The action variable

\(x \in \{\text{no action}, \text{service}, \text{replace}\}\)

is the hold-replacement-maintenance decision.

X = np.array(['no action', 'service', 'replace']) # vector of actions

m = len(X) # number of actions

Reward Function¶

The reward function is

Assuming a profit contribution \(p(a) = 50 − 2.5a −2.5a^2\) that is a function of the asset age \(a\) in years.

Here, the rows of the reward matrix, which correspond to the three admissible decisions (no action, service, replace), are computed individually.

f = np.zeros((m, n))

q = 50 - 2.5 * S1 - 2.5 * S1 ** 2

f[0] = q * np.minimum(1, 1 - (S1 - S2) / maxage)

f[1] = q * np.minimum(1, 1 - (S1 - S2 - 1) / maxage) - mancost

f[2] = 50 - repcost

State Transition Function¶

The state transition function is

Here, the routine getindex is used to find the index of the following period’s state.

g = np.empty_like(f)

g[0] = getindex(np.c_[S1 + 1, S2], S)

g[1] = getindex(np.c_[S1 + 1, S2 + 1], S)

g[2] = getindex(np.c_[1, 0], S)

Model Structure¶

The value of asset of age \(a\) that has undergone \(s\) servicings satisfies the Bellman equation

where we set \(p(n, s) = −\infty\) for all \(s\) to enforce replacement of an asset of age \(n\). The Bellman equation asserts that if the manufacturer replaces an asset of age \(a\) with servicings \(s\), he earns \(p(0,0) − c\) over the coming year and begins the subsequent year with an asset worth \(V(1,0)\); if he services the asset, he earns \(p(a, s + 1) − k\) over the coming year and begins the subsequent year with an asset worth \(V(a + 1, s + 1)\). As with the previous example, the value \(V(a, s)\) measures not only the current and future net earnings of the asset, but also the net earnings of all future assets that replace it.

To solve and simulate this model, use the CompEcon class DDPmodel.

model = DDPmodel(f, g, delta)

model.solve()

A deterministic discrete state, discrete action, dynamic model.

There are 3 possible actions over 25 possible states

Analysis¶

Simulate Model¶

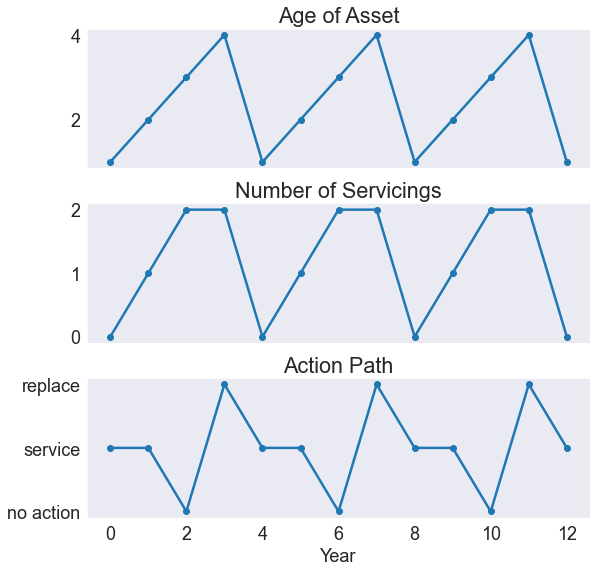

The paths are computed by performing q deterministic simulation of 12 years in duration using the simulate() method.

sinit = 0

nyrs = 12

t = np.arange(nyrs + 1)

spath, xpath = model.simulate(sinit, nyrs)

pd.Categorical(X[xpath], categories=X)

['service', 'service', 'no action', 'replace', 'service', ..., 'service', 'service', 'no action', 'replace', 'service']

Length: 13

Categories (3, object): ['no action', 'service', 'replace']

simul = pd.DataFrame({

'Year': t,

'Age of Asset': S1[spath],

'Number of Servicings': S2[spath]}).set_index('Year')

simul['Action'] = pd.Categorical(X[xpath], categories=X)

simul

| Age of Asset | Number of Servicings | Action | |

|---|---|---|---|

| Year | |||

| 0 | 1 | 0 | service |

| 1 | 2 | 1 | service |

| 2 | 3 | 2 | no action |

| 3 | 4 | 2 | replace |

| 4 | 1 | 0 | service |

| 5 | 2 | 1 | service |

| 6 | 3 | 2 | no action |

| 7 | 4 | 2 | replace |

| 8 | 1 | 0 | service |

| 9 | 2 | 1 | service |

| 10 | 3 | 2 | no action |

| 11 | 4 | 2 | replace |

| 12 | 1 | 0 | service |

Plot State Paths (Age and Servicings) and Action Path¶

The asset is replaced every four years, and is serviced twice, at the beginning of the second and third years of operation.

fig, axs = plt.subplots(3, 1, sharex=True, figsize=[9,9])

simul['Age of Asset'].plot(marker='o', ax=axs[0])

axs[0].set(title='Age of Asset')

simul['Number of Servicings'].plot(marker='o', ax=axs[1])

axs[1].set(title='Number of Servicings')

simul['Action'].cat.codes.plot(marker='o', ax=axs[2])

axs[2].set(title='Action Path', yticks=range(3), yticklabels=X);