Deterministic Optimal Consumption-Investment Model

Contents

Deterministic Optimal Consumption-Investment Model¶

Randall Romero Aguilar, PhD

This demo is based on the original Matlab demo accompanying the Computational Economics and Finance 2001 textbook by Mario Miranda and Paul Fackler.

Original (Matlab) CompEcon file: demdoc01.m

Running this file requires the Python version of CompEcon. This can be installed with pip by running

!pip install compecon --upgrade

Last updated: 2021-Oct-01

About¶

Utility maximizing agent must decide how much to consume and how much to hold in a riskless asset.

State

w stock of wealth

Control

q consumption rate

Parameters

theta relative risk aversion

r continuous rate of return on asset

rho continuous discount rate

Preliminary tasks¶

import pandas as pd

import matplotlib.pyplot as plt

from compecon import ODE

Initial state and time horizon¶

winit = 1 # initial capital stock

T = 50 # time horizon

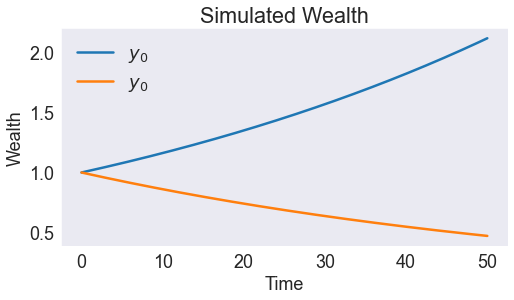

SOLUTION & SIMULATION \(r>\rho\)¶

Model parameters¶

𝜃 = 2.0 # relative risk aversion

r = 0.08 # continuous rate of return on asset

𝜌 = 0.05 # continuous discount rate

# V'>0 iff V''<0 iff sign>0 where

sign = 𝜌 - r*(1-𝜃)

if sign<0:

print('Invalid Parameters')

Solve ODE¶

g = lambda w: ((r-𝜌)/𝜃)*w

problem1 = ODE(g, T, [winit])

problem1.rk4(xnames=[r"$r>\rho$"])

PARAMETER xnames NO LONGER VALID. SET labels= AT OBJECT CREATION

SOLUTION & SIMULATION \(r<\rho\)¶

Model Parameters¶

𝜃 = 2.0 # relative risk aversion

r = 0.05 # continuous rate of return on asset

𝜌 = 0.08 # continuous discount rate

# Assume theta>0. Then V'>0 iff V''<0 iff sign>0 where

sign = 𝜌 - r*(1-𝜃)

if sign<0:

print('Invalid Parameters')

Solve ODE¶

g = lambda w: ((r-𝜌)/𝜃)*w

problem2 = ODE(g, T, [winit])

problem2.rk4(xnames=[r"$r<\rho$"])

PARAMETER xnames NO LONGER VALID. SET labels= AT OBJECT CREATION

PLOT SOLUTIONS¶

# Plot optimal wealth path

fig, ax= plt.subplots(figsize=[8,4])

wealth = pd.concat([problem1.x, problem2.x], axis=1)

wealth.plot(ax=ax)

ax.set(title='Simulated Wealth',

xlabel='Time',

ylabel='Wealth');