Deterministic Optimal Economic Growth Model

Contents

Deterministic Optimal Economic Growth Model¶

Randall Romero Aguilar, PhD

This demo is based on the original Matlab demo accompanying the Computational Economics and Finance 2001 textbook by Mario Miranda and Paul Fackler.

Original (Matlab) CompEcon file: demdoc02.m

Running this file requires the Python version of CompEcon. This can be installed with pip by running

!pip install compecon --upgrade

Last updated: 2021-Oct-01

About¶

Social benefit maximizing social planner must decide how much society should consume and invest.

State

k capital stock

Control

q consumption rate

Parameters

𝛼 capital share

𝛿 capital depreciation rate

𝜃 relative risk aversion

𝜌 continuous discount rate

Preliminary tasks¶

Import relevant packages¶

import pandas as pd

import matplotlib.pyplot as plt

from compecon import BasisChebyshev, OCmodel

Model parameters¶

𝛼 = 0.4 # capital share

𝛿 = 0.1 # capital depreciation rate

𝜃 = 2.0 # relative risk aversion

𝜌 = 0.05 # continuous discount rate

Approximation structure¶

n = 21 # number of basis functions

kmin = 1 # minimum state

kmax = 7 # maximum state

basis = BasisChebyshev(n, kmin, kmax, labels=['Capital Stock']) # basis functions

Steady-state¶

kstar = ((𝛿+𝜌)/𝛼)**(1/(𝛼-1)) # capital stock

qstar = kstar**𝛼 - 𝛿*kstar # consumption rate

vstar = ((1/(1-𝜃))*qstar**(1-𝜃))/𝜌 # value

lstar = qstar ** (-𝜃) # shadow price

steadystate = pd.Series([kstar, qstar, vstar, lstar],

index=['Capital stock', 'Rate of consumption', 'Value Function', 'Shadow Price'])

steadystate

Capital stock 5.127998

Rate of consumption 1.410200

Value Function -14.182390

Shadow Price 0.502850

dtype: float64

Solve HJB equation by collocation¶

Initial guess¶

k = basis.nodes

basis.y = ((𝜌*k)**(1-𝜃))/(1-𝜃)

Define model and solve it.¶

def control(k, Vk, 𝛼,𝛿,𝜃,𝜌):

return Vk**(-1/𝜃)

def reward(k, q, 𝛼,𝛿,𝜃,𝜌):

return (1/(1-𝜃)) * q**(1-𝜃)

def transition(k, q, 𝛼,𝛿,𝜃,𝜌):

return k**𝛼 - 𝛿*k - q

model = OCmodel(basis, control, reward, transition, rho=𝜌, params=[𝛼,𝛿,𝜃,𝜌])

data = model.solve()

Solving optimal control model

iter change time

------------------------------

0 8.4e+00 0.0010

1 7.8e-01 0.0020

2 1.5e-01 0.0020

3 8.1e-03 0.0020

4 2.9e-05 0.0030

5 4.4e-10 0.0030

Elapsed Time = 0.00 Seconds

Plots¶

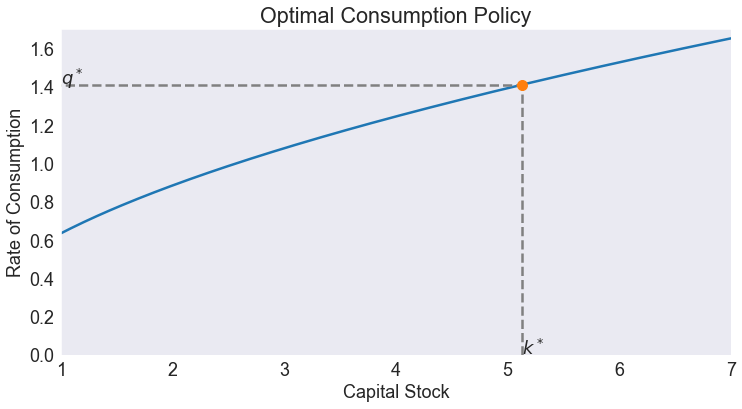

Optimal policy¶

fig, ax = plt.subplots()

data['control'].plot(ax=ax)

ax.set(title='Optimal Consumption Policy',

xlabel='Capital Stock',

ylabel='Rate of Consumption',

xlim=[kmin, kmax])

ax.set_ylim(bottom=0)

ax.hlines(qstar, 0, kstar, colors=['gray'], linestyles=['--'])

ax.vlines(kstar, 0, qstar, colors=['gray'], linestyles=['--'])

ax.annotate('$q^*$', (kmin, qstar))

ax.annotate('$k^*$', (kstar, 0))

ax.plot(kstar, qstar, '.', ms=20);

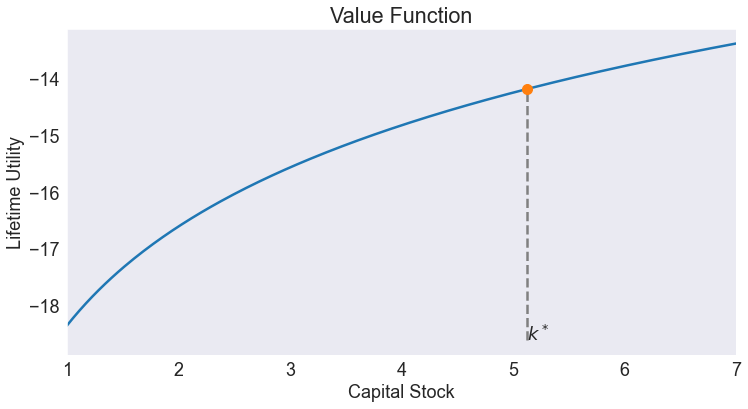

Value function¶

fig, ax = plt.subplots()

data['value'].plot(ax=ax)

ax.set(title='Value Function',

xlabel='Capital Stock',

ylabel='Lifetime Utility',

xlim=[kmin, kmax])

lb = ax.get_ylim()[0]

ax.vlines(kstar, lb , vstar, colors=['gray'], linestyles=['--'])

ax.annotate('$k^*$', (kstar, lb))

ax.plot(kstar, vstar, '.', ms=20);

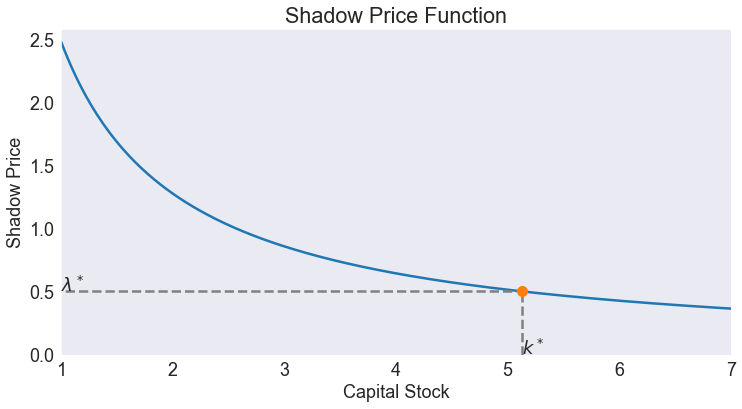

Shadow price¶

data['shadow'] = model.Value(data.index, 1)

fig, ax = plt.subplots()

data['shadow'].plot(ax=ax)

ax.set(title='Shadow Price Function',

xlabel='Capital Stock',

ylabel='Shadow Price',

xlim=[kmin, kmax])

ax.set_ylim(bottom=0)

ax.hlines(lstar, 0, kstar, colors=['gray'], linestyles=['--'])

ax.vlines(kstar, 0 , lstar, colors=['gray'], linestyles=['--'])

ax.annotate('$\lambda^*$', (kmin, lstar))

ax.annotate('$k^*$', (kstar, 0))

ax.plot(kstar, lstar, '.', ms=20);

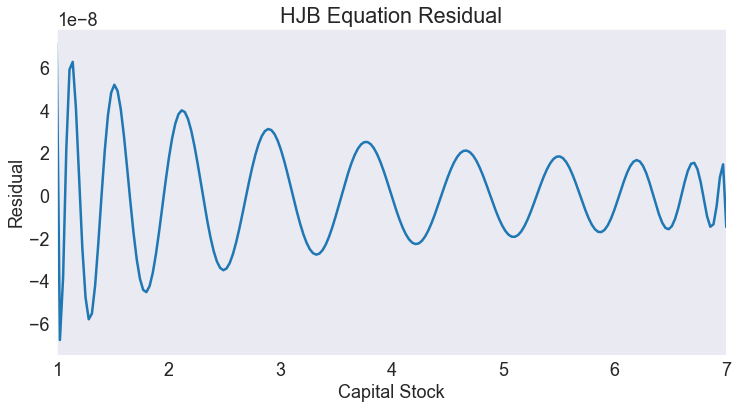

Residual¶

fig, ax = plt.subplots()

data['resid'].plot(ax=ax)

ax.set(title='HJB Equation Residual',

xlabel='Capital Stock',

ylabel='Residual',

xlim=[kmin, kmax]);

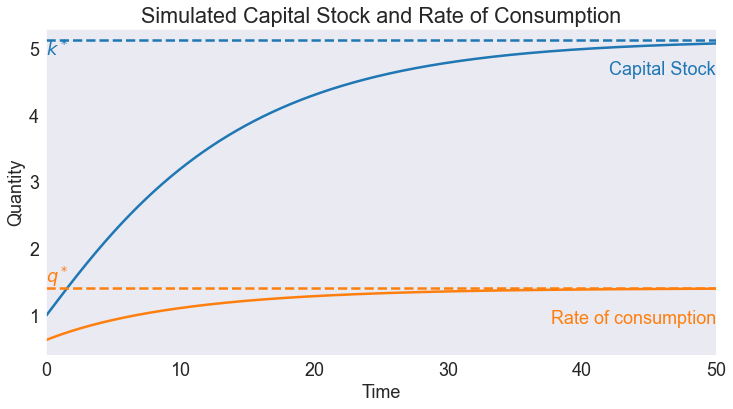

Simulate the model¶

Initial state and time horizon¶

k0 = kmin # initial capital stock

T = 50 # time horizon

Simulation and plot¶

fig, ax = plt.subplots()

model.simulate([k0], T).plot(ax=ax)

ax.set(title='Simulated Capital Stock and Rate of Consumption',

xlabel='Time',

ylabel='Quantity',

xlim=[0, T])

ax.axhline(kstar, ls='--', c='C0')

ax.axhline(qstar, ls='--', c='C1')

ax.annotate('$k^*$', (0, kstar), color='C0', va='top')

ax.annotate('$q^*$', (0, qstar), color='C1', va='bottom')

ax.annotate('\nCapital Stock', (T, kstar), color='C0', ha='right', va='top')

ax.annotate('\nRate of consumption', (T, qstar), color='C1', ha='right', va='top')

ax.legend([]);

PARAMETER xnames NO LONGER VALID. SET labels= AT OBJECT CREATION