Replicando el trabajo de Nelson y Plosser (1982)

Contents

4.4. Replicando el trabajo de Nelson y Plosser (1982)#

En un artículo muy citado

Nelson y Plosser 1982 Trends and Random Walks in Macroeconomic Time Series: Some evidence and implications. Journal of Monetary Economics 10, pp.139-162

los autores examinan varias series macroeconómicas de uso común.

Usando pruebas de Dickey-Fuller, encontraron que todas las series macroeconómicas contienen raíces unitarias, o más correctamente, que no podían rechazar la hipótesis nula de un raíz unitaria.

En esta parte del laboratorio replicamos algunos de los resultados de Nelson y Plosser.

Preparación#

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from statsmodels.tsa.stattools import acf, kpss

from statsmodels.formula.api import ols

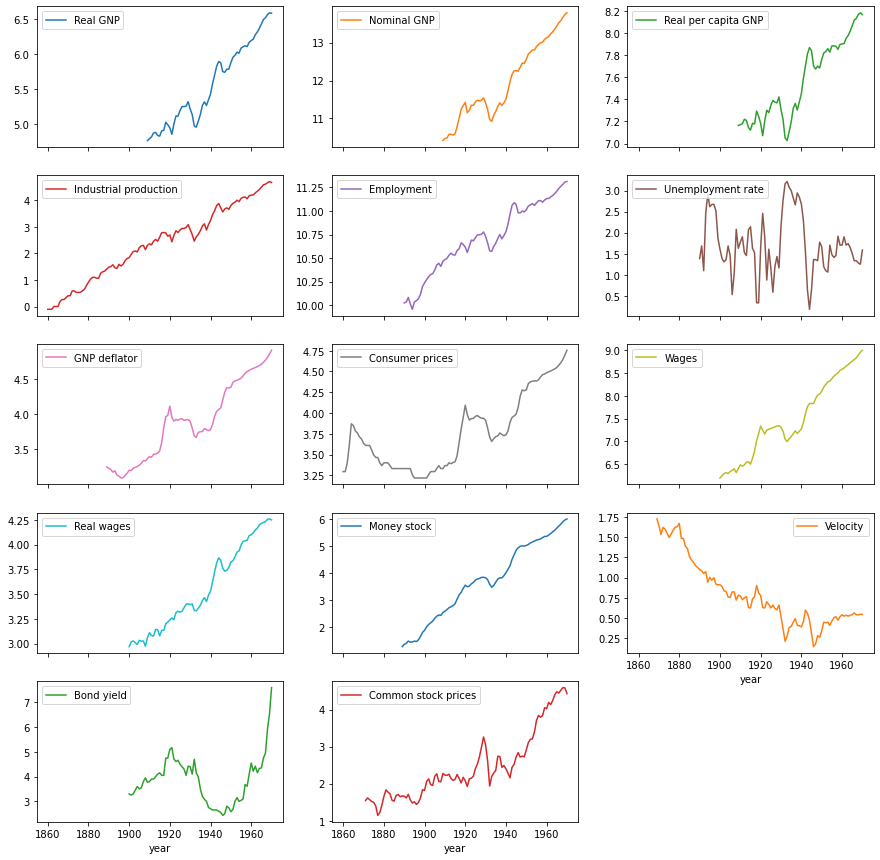

Leer los datos y visualizarlos#

datos = pd.read_stata('https://github.com/randall-romero/econometria/raw/master/data/NelsonPlosserData.dta')

datos.set_index('year',inplace=True)

datos.index = datos.index.year

titulos = [f'r{i}' for i in range(1,7)] # para rotular unas tablas abajo

variables = {'lrgnp':'Real GNP',

'lgnp':'Nominal GNP',

'lpcrgnp':'Real per capita GNP',

'lip':'Industrial production',

'lemp':'Employment',

'lun':'Unemployment rate',

'lprgnp':'GNP deflator',

'lcpi':'Consumer prices',

'lwg':'Wages',

'lrwg':'Real wages',

'lm':'Money stock',

'lvel':'Velocity',

'bnd':'Bond yield',

'lsp500':'Common stock prices'}

datos = datos[variables.keys()].rename(columns=variables)

datos.plot(subplots=True, figsize=[15,15], layout=[-1,3]);

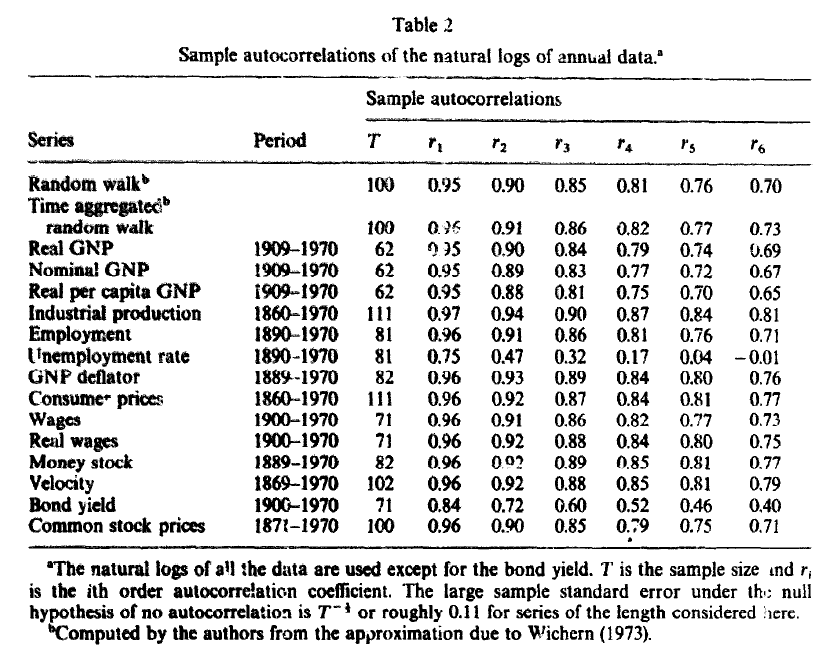

Calculando autocorrelaciones#

Fuente: Nelson y Plosser 1982 Trends and Random Walks in Macroeconomic Time Series: Some evidence and implications. Journal of Monetary Economics 10, pp.139-162

def acf6lags(nombre_variable, d):

"""

Calcula los primeros 6 coeficientes de autocorrelación

Args:

nombre_variable: str, el nombre de una columna de la tabla "datos"

d: número de veces que hay que diferenciar la serie (0 o 1 en la práctica)

Returns:

np.array, los 6 coeficientes de autocorrelación, redondeados a dos decimales

"""

serie = datos[nombre_variable].diff(d) if d>0 else datos[nombre_variable]

return acf(serie.dropna(), nlags=6, fft=False)[1:].round(2)

def tabla_acf(d):

"""

Crea una tabla con las primeras 6 autocorrelaciones de todas las series en "datos"

Args:

d: int, número de veces que hay que diferenciar la serie (0 o 1 en la práctica)

Returns:

una tabla de pandas, series en las filas, número de rezagos en las columnas

"""

return pd.DataFrame([acf6lags(serie,d) for serie in datos], index=variables.values(), columns=titulos)

Serie en nivel#

tabla2 = tabla_acf(0)

tabla2

| r1 | r2 | r3 | r4 | r5 | r6 | |

|---|---|---|---|---|---|---|

| Real GNP | 0.95 | 0.90 | 0.84 | 0.79 | 0.74 | 0.69 |

| Nominal GNP | 0.95 | 0.89 | 0.83 | 0.77 | 0.72 | 0.67 |

| Real per capita GNP | 0.95 | 0.88 | 0.81 | 0.75 | 0.70 | 0.65 |

| Industrial production | 0.97 | 0.94 | 0.90 | 0.87 | 0.84 | 0.81 |

| Employment | 0.96 | 0.91 | 0.86 | 0.81 | 0.76 | 0.71 |

| Unemployment rate | 0.75 | 0.47 | 0.32 | 0.17 | 0.04 | -0.01 |

| GNP deflator | 0.96 | 0.93 | 0.89 | 0.84 | 0.80 | 0.76 |

| Consumer prices | 0.96 | 0.92 | 0.87 | 0.84 | 0.80 | 0.77 |

| Wages | 0.96 | 0.91 | 0.86 | 0.82 | 0.77 | 0.73 |

| Real wages | 0.96 | 0.92 | 0.88 | 0.84 | 0.80 | 0.75 |

| Money stock | 0.96 | 0.92 | 0.89 | 0.85 | 0.81 | 0.77 |

| Velocity | 0.96 | 0.92 | 0.88 | 0.85 | 0.81 | 0.79 |

| Bond yield | 0.84 | 0.72 | 0.60 | 0.52 | 0.46 | 0.40 |

| Common stock prices | 0.96 | 0.90 | 0.85 | 0.79 | 0.75 | 0.71 |

def rango_datos(ser):

"""

Determina el rango de los datos disponibles de una serie

Args:

ser: una serie de pandas

Returns:

str, primera observación -- última observación

"""

return f'{ser.first_valid_index()} -- {ser.last_valid_index()}'

datos.apply(rango_datos)

Real GNP 1909 -- 1970

Nominal GNP 1909 -- 1970

Real per capita GNP 1909 -- 1970

Industrial production 1860 -- 1970

Employment 1890 -- 1970

Unemployment rate 1890 -- 1970

GNP deflator 1889 -- 1970

Consumer prices 1860 -- 1970

Wages 1900 -- 1970

Real wages 1900 -- 1970

Money stock 1889 -- 1970

Velocity 1869 -- 1970

Bond yield 1900 -- 1970

Common stock prices 1871 -- 1970

dtype: object

tabla2.insert(0,'Period', datos.apply(rango_datos))

tabla2.insert(1, 'T', datos.apply(lambda ser: ser.dropna().count()))

tabla2

| Period | T | r1 | r2 | r3 | r4 | r5 | r6 | |

|---|---|---|---|---|---|---|---|---|

| Real GNP | 1909 -- 1970 | 62 | 0.95 | 0.90 | 0.84 | 0.79 | 0.74 | 0.69 |

| Nominal GNP | 1909 -- 1970 | 62 | 0.95 | 0.89 | 0.83 | 0.77 | 0.72 | 0.67 |

| Real per capita GNP | 1909 -- 1970 | 62 | 0.95 | 0.88 | 0.81 | 0.75 | 0.70 | 0.65 |

| Industrial production | 1860 -- 1970 | 111 | 0.97 | 0.94 | 0.90 | 0.87 | 0.84 | 0.81 |

| Employment | 1890 -- 1970 | 81 | 0.96 | 0.91 | 0.86 | 0.81 | 0.76 | 0.71 |

| Unemployment rate | 1890 -- 1970 | 81 | 0.75 | 0.47 | 0.32 | 0.17 | 0.04 | -0.01 |

| GNP deflator | 1889 -- 1970 | 82 | 0.96 | 0.93 | 0.89 | 0.84 | 0.80 | 0.76 |

| Consumer prices | 1860 -- 1970 | 111 | 0.96 | 0.92 | 0.87 | 0.84 | 0.80 | 0.77 |

| Wages | 1900 -- 1970 | 71 | 0.96 | 0.91 | 0.86 | 0.82 | 0.77 | 0.73 |

| Real wages | 1900 -- 1970 | 71 | 0.96 | 0.92 | 0.88 | 0.84 | 0.80 | 0.75 |

| Money stock | 1889 -- 1970 | 82 | 0.96 | 0.92 | 0.89 | 0.85 | 0.81 | 0.77 |

| Velocity | 1869 -- 1970 | 102 | 0.96 | 0.92 | 0.88 | 0.85 | 0.81 | 0.79 |

| Bond yield | 1900 -- 1970 | 71 | 0.84 | 0.72 | 0.60 | 0.52 | 0.46 | 0.40 |

| Common stock prices | 1871 -- 1970 | 100 | 0.96 | 0.90 | 0.85 | 0.79 | 0.75 | 0.71 |

Serie en primera diferencia#

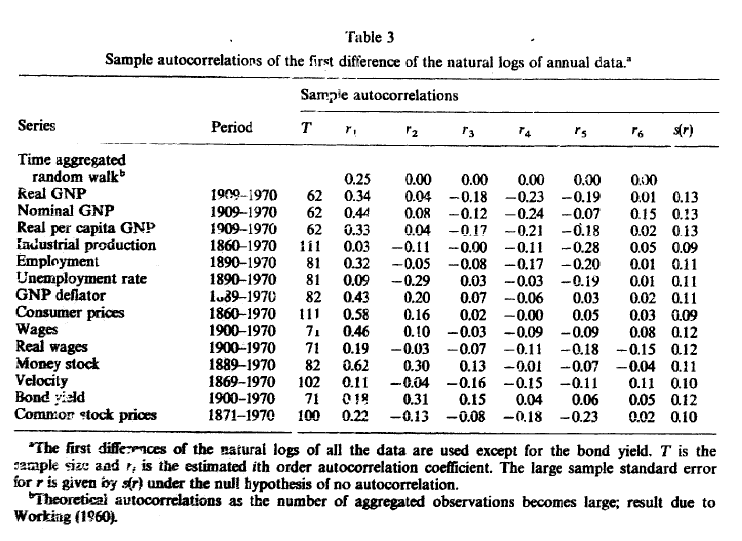

Fuente: Nelson y Plosser 1982 Trends and Random Walks in Macroeconomic Time Series: Some evidence and implications. Journal of Monetary Economics 10, pp.139-162

tabla3 = tabla_acf(1)

tabla3.insert(0,'Period', datos.apply(rango_datos))

tabla3.insert(1, 'T', datos.apply(lambda ser: ser.dropna().count()))

tabla3

| Period | T | r1 | r2 | r3 | r4 | r5 | r6 | |

|---|---|---|---|---|---|---|---|---|

| Real GNP | 1909 -- 1970 | 62 | 0.34 | 0.04 | -0.18 | -0.23 | -0.19 | 0.01 |

| Nominal GNP | 1909 -- 1970 | 62 | 0.44 | 0.08 | -0.12 | -0.24 | -0.07 | 0.15 |

| Real per capita GNP | 1909 -- 1970 | 62 | 0.33 | 0.04 | -0.17 | -0.21 | -0.18 | 0.02 |

| Industrial production | 1860 -- 1970 | 111 | 0.03 | -0.11 | -0.00 | -0.11 | -0.28 | 0.05 |

| Employment | 1890 -- 1970 | 81 | 0.32 | -0.05 | -0.08 | -0.17 | -0.20 | 0.01 |

| Unemployment rate | 1890 -- 1970 | 81 | 0.09 | -0.29 | 0.03 | -0.03 | -0.19 | 0.01 |

| GNP deflator | 1889 -- 1970 | 82 | 0.43 | 0.20 | 0.07 | -0.06 | 0.03 | 0.02 |

| Consumer prices | 1860 -- 1970 | 111 | 0.58 | 0.16 | 0.02 | -0.00 | 0.05 | 0.03 |

| Wages | 1900 -- 1970 | 71 | 0.46 | 0.10 | -0.03 | -0.09 | -0.09 | 0.08 |

| Real wages | 1900 -- 1970 | 71 | 0.19 | -0.03 | -0.07 | -0.11 | -0.18 | -0.15 |

| Money stock | 1889 -- 1970 | 82 | 0.62 | 0.30 | 0.13 | -0.01 | -0.07 | -0.04 |

| Velocity | 1869 -- 1970 | 102 | 0.11 | -0.04 | -0.16 | -0.15 | -0.11 | 0.11 |

| Bond yield | 1900 -- 1970 | 71 | 0.18 | 0.31 | 0.15 | 0.04 | 0.06 | 0.05 |

| Common stock prices | 1871 -- 1970 | 100 | 0.22 | -0.13 | -0.08 | -0.18 | -0.23 | 0.02 |

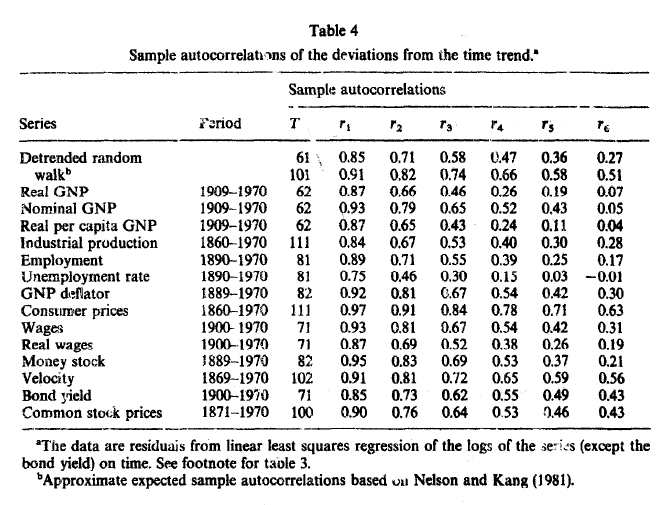

Desviaciones respecto a una tendencia lineal#

Fuente: Nelson y Plosser 1982 Trends and Random Walks in Macroeconomic Time Series: Some evidence and implications. Journal of Monetary Economics 10, pp.139-162

def acf_deviation_from_trend(nombre_variable):

"""

Calcular las primeras 6 autocorrelaciones de la desviación de una serie respecto a

su tendencia lineal.

Se estima por mínimos cuadrados ordinarios una regresión de la forma

y = intercepto + time

y se calcula la autocorrelación de los residuos.

Args:

nombre_variable: str, nombre de una variable de la tabla "datos"

Returns:

np.array, los 6 coeficientes de autocorrelación, redondeados a dos decimales

"""

temp = datos[[nombre_variable]].dropna()

temp.columns = ['y']

temp['t'] = np.arange(temp.shape[0])

resid = ols('y ~ t', temp).fit().resid

return acf(resid, nlags=6, fft=False)[1:].round(2)

tabla4 = pd.DataFrame([acf_deviation_from_trend(ser) for ser in datos], index=variables.values(), columns=titulos)

tabla4.insert(0,'Period', datos.apply(rango_datos))

tabla4.insert(1, 'T', datos.apply(lambda ser: ser.dropna().count()))

tabla4

| Period | T | r1 | r2 | r3 | r4 | r5 | r6 | |

|---|---|---|---|---|---|---|---|---|

| Real GNP | 1909 -- 1970 | 62 | 0.87 | 0.66 | 0.44 | 0.26 | 0.13 | 0.07 |

| Nominal GNP | 1909 -- 1970 | 62 | 0.93 | 0.79 | 0.65 | 0.52 | 0.43 | 0.35 |

| Real per capita GNP | 1909 -- 1970 | 62 | 0.87 | 0.65 | 0.43 | 0.24 | 0.11 | 0.04 |

| Industrial production | 1860 -- 1970 | 111 | 0.84 | 0.67 | 0.53 | 0.40 | 0.29 | 0.28 |

| Employment | 1890 -- 1970 | 81 | 0.89 | 0.71 | 0.55 | 0.39 | 0.25 | 0.17 |

| Unemployment rate | 1890 -- 1970 | 81 | 0.75 | 0.46 | 0.30 | 0.15 | 0.03 | -0.01 |

| GNP deflator | 1889 -- 1970 | 82 | 0.92 | 0.81 | 0.67 | 0.54 | 0.42 | 0.30 |

| Consumer prices | 1860 -- 1970 | 111 | 0.97 | 0.91 | 0.84 | 0.78 | 0.71 | 0.63 |

| Wages | 1900 -- 1970 | 71 | 0.93 | 0.81 | 0.67 | 0.54 | 0.42 | 0.31 |

| Real wages | 1900 -- 1970 | 71 | 0.87 | 0.69 | 0.52 | 0.38 | 0.26 | 0.19 |

| Money stock | 1889 -- 1970 | 82 | 0.95 | 0.83 | 0.69 | 0.53 | 0.37 | 0.21 |

| Velocity | 1869 -- 1970 | 102 | 0.91 | 0.81 | 0.72 | 0.65 | 0.59 | 0.56 |

| Bond yield | 1900 -- 1970 | 71 | 0.85 | 0.73 | 0.62 | 0.55 | 0.49 | 0.43 |

| Common stock prices | 1871 -- 1970 | 100 | 0.90 | 0.76 | 0.64 | 0.53 | 0.46 | 0.43 |

Mostrar las tablas 2 a 4 en una sola#

pd.concat([tabla2, tabla3, tabla4], axis=1)

| Period | T | r1 | r2 | r3 | r4 | r5 | r6 | Period | T | ... | r5 | r6 | Period | T | r1 | r2 | r3 | r4 | r5 | r6 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Real GNP | 1909 -- 1970 | 62 | 0.95 | 0.90 | 0.84 | 0.79 | 0.74 | 0.69 | 1909 -- 1970 | 62 | ... | -0.19 | 0.01 | 1909 -- 1970 | 62 | 0.87 | 0.66 | 0.44 | 0.26 | 0.13 | 0.07 |

| Nominal GNP | 1909 -- 1970 | 62 | 0.95 | 0.89 | 0.83 | 0.77 | 0.72 | 0.67 | 1909 -- 1970 | 62 | ... | -0.07 | 0.15 | 1909 -- 1970 | 62 | 0.93 | 0.79 | 0.65 | 0.52 | 0.43 | 0.35 |

| Real per capita GNP | 1909 -- 1970 | 62 | 0.95 | 0.88 | 0.81 | 0.75 | 0.70 | 0.65 | 1909 -- 1970 | 62 | ... | -0.18 | 0.02 | 1909 -- 1970 | 62 | 0.87 | 0.65 | 0.43 | 0.24 | 0.11 | 0.04 |

| Industrial production | 1860 -- 1970 | 111 | 0.97 | 0.94 | 0.90 | 0.87 | 0.84 | 0.81 | 1860 -- 1970 | 111 | ... | -0.28 | 0.05 | 1860 -- 1970 | 111 | 0.84 | 0.67 | 0.53 | 0.40 | 0.29 | 0.28 |

| Employment | 1890 -- 1970 | 81 | 0.96 | 0.91 | 0.86 | 0.81 | 0.76 | 0.71 | 1890 -- 1970 | 81 | ... | -0.20 | 0.01 | 1890 -- 1970 | 81 | 0.89 | 0.71 | 0.55 | 0.39 | 0.25 | 0.17 |

| Unemployment rate | 1890 -- 1970 | 81 | 0.75 | 0.47 | 0.32 | 0.17 | 0.04 | -0.01 | 1890 -- 1970 | 81 | ... | -0.19 | 0.01 | 1890 -- 1970 | 81 | 0.75 | 0.46 | 0.30 | 0.15 | 0.03 | -0.01 |

| GNP deflator | 1889 -- 1970 | 82 | 0.96 | 0.93 | 0.89 | 0.84 | 0.80 | 0.76 | 1889 -- 1970 | 82 | ... | 0.03 | 0.02 | 1889 -- 1970 | 82 | 0.92 | 0.81 | 0.67 | 0.54 | 0.42 | 0.30 |

| Consumer prices | 1860 -- 1970 | 111 | 0.96 | 0.92 | 0.87 | 0.84 | 0.80 | 0.77 | 1860 -- 1970 | 111 | ... | 0.05 | 0.03 | 1860 -- 1970 | 111 | 0.97 | 0.91 | 0.84 | 0.78 | 0.71 | 0.63 |

| Wages | 1900 -- 1970 | 71 | 0.96 | 0.91 | 0.86 | 0.82 | 0.77 | 0.73 | 1900 -- 1970 | 71 | ... | -0.09 | 0.08 | 1900 -- 1970 | 71 | 0.93 | 0.81 | 0.67 | 0.54 | 0.42 | 0.31 |

| Real wages | 1900 -- 1970 | 71 | 0.96 | 0.92 | 0.88 | 0.84 | 0.80 | 0.75 | 1900 -- 1970 | 71 | ... | -0.18 | -0.15 | 1900 -- 1970 | 71 | 0.87 | 0.69 | 0.52 | 0.38 | 0.26 | 0.19 |

| Money stock | 1889 -- 1970 | 82 | 0.96 | 0.92 | 0.89 | 0.85 | 0.81 | 0.77 | 1889 -- 1970 | 82 | ... | -0.07 | -0.04 | 1889 -- 1970 | 82 | 0.95 | 0.83 | 0.69 | 0.53 | 0.37 | 0.21 |

| Velocity | 1869 -- 1970 | 102 | 0.96 | 0.92 | 0.88 | 0.85 | 0.81 | 0.79 | 1869 -- 1970 | 102 | ... | -0.11 | 0.11 | 1869 -- 1970 | 102 | 0.91 | 0.81 | 0.72 | 0.65 | 0.59 | 0.56 |

| Bond yield | 1900 -- 1970 | 71 | 0.84 | 0.72 | 0.60 | 0.52 | 0.46 | 0.40 | 1900 -- 1970 | 71 | ... | 0.06 | 0.05 | 1900 -- 1970 | 71 | 0.85 | 0.73 | 0.62 | 0.55 | 0.49 | 0.43 |

| Common stock prices | 1871 -- 1970 | 100 | 0.96 | 0.90 | 0.85 | 0.79 | 0.75 | 0.71 | 1871 -- 1970 | 100 | ... | -0.23 | 0.02 | 1871 -- 1970 | 100 | 0.90 | 0.76 | 0.64 | 0.53 | 0.46 | 0.43 |

14 rows × 24 columns

pd.concat([tabla2, tabla3.iloc[:,-6:], tabla4.iloc[:,-6:]], axis=1, keys=['Niveles','Diferencias','Desviación de tendencia'])

| Niveles | Diferencias | Desviación de tendencia | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Period | T | r1 | r2 | r3 | r4 | r5 | r6 | r1 | r2 | r3 | r4 | r5 | r6 | r1 | r2 | r3 | r4 | r5 | r6 | |

| Real GNP | 1909 -- 1970 | 62 | 0.95 | 0.90 | 0.84 | 0.79 | 0.74 | 0.69 | 0.34 | 0.04 | -0.18 | -0.23 | -0.19 | 0.01 | 0.87 | 0.66 | 0.44 | 0.26 | 0.13 | 0.07 |

| Nominal GNP | 1909 -- 1970 | 62 | 0.95 | 0.89 | 0.83 | 0.77 | 0.72 | 0.67 | 0.44 | 0.08 | -0.12 | -0.24 | -0.07 | 0.15 | 0.93 | 0.79 | 0.65 | 0.52 | 0.43 | 0.35 |

| Real per capita GNP | 1909 -- 1970 | 62 | 0.95 | 0.88 | 0.81 | 0.75 | 0.70 | 0.65 | 0.33 | 0.04 | -0.17 | -0.21 | -0.18 | 0.02 | 0.87 | 0.65 | 0.43 | 0.24 | 0.11 | 0.04 |

| Industrial production | 1860 -- 1970 | 111 | 0.97 | 0.94 | 0.90 | 0.87 | 0.84 | 0.81 | 0.03 | -0.11 | -0.00 | -0.11 | -0.28 | 0.05 | 0.84 | 0.67 | 0.53 | 0.40 | 0.29 | 0.28 |

| Employment | 1890 -- 1970 | 81 | 0.96 | 0.91 | 0.86 | 0.81 | 0.76 | 0.71 | 0.32 | -0.05 | -0.08 | -0.17 | -0.20 | 0.01 | 0.89 | 0.71 | 0.55 | 0.39 | 0.25 | 0.17 |

| Unemployment rate | 1890 -- 1970 | 81 | 0.75 | 0.47 | 0.32 | 0.17 | 0.04 | -0.01 | 0.09 | -0.29 | 0.03 | -0.03 | -0.19 | 0.01 | 0.75 | 0.46 | 0.30 | 0.15 | 0.03 | -0.01 |

| GNP deflator | 1889 -- 1970 | 82 | 0.96 | 0.93 | 0.89 | 0.84 | 0.80 | 0.76 | 0.43 | 0.20 | 0.07 | -0.06 | 0.03 | 0.02 | 0.92 | 0.81 | 0.67 | 0.54 | 0.42 | 0.30 |

| Consumer prices | 1860 -- 1970 | 111 | 0.96 | 0.92 | 0.87 | 0.84 | 0.80 | 0.77 | 0.58 | 0.16 | 0.02 | -0.00 | 0.05 | 0.03 | 0.97 | 0.91 | 0.84 | 0.78 | 0.71 | 0.63 |

| Wages | 1900 -- 1970 | 71 | 0.96 | 0.91 | 0.86 | 0.82 | 0.77 | 0.73 | 0.46 | 0.10 | -0.03 | -0.09 | -0.09 | 0.08 | 0.93 | 0.81 | 0.67 | 0.54 | 0.42 | 0.31 |

| Real wages | 1900 -- 1970 | 71 | 0.96 | 0.92 | 0.88 | 0.84 | 0.80 | 0.75 | 0.19 | -0.03 | -0.07 | -0.11 | -0.18 | -0.15 | 0.87 | 0.69 | 0.52 | 0.38 | 0.26 | 0.19 |

| Money stock | 1889 -- 1970 | 82 | 0.96 | 0.92 | 0.89 | 0.85 | 0.81 | 0.77 | 0.62 | 0.30 | 0.13 | -0.01 | -0.07 | -0.04 | 0.95 | 0.83 | 0.69 | 0.53 | 0.37 | 0.21 |

| Velocity | 1869 -- 1970 | 102 | 0.96 | 0.92 | 0.88 | 0.85 | 0.81 | 0.79 | 0.11 | -0.04 | -0.16 | -0.15 | -0.11 | 0.11 | 0.91 | 0.81 | 0.72 | 0.65 | 0.59 | 0.56 |

| Bond yield | 1900 -- 1970 | 71 | 0.84 | 0.72 | 0.60 | 0.52 | 0.46 | 0.40 | 0.18 | 0.31 | 0.15 | 0.04 | 0.06 | 0.05 | 0.85 | 0.73 | 0.62 | 0.55 | 0.49 | 0.43 |

| Common stock prices | 1871 -- 1970 | 100 | 0.96 | 0.90 | 0.85 | 0.79 | 0.75 | 0.71 | 0.22 | -0.13 | -0.08 | -0.18 | -0.23 | 0.02 | 0.90 | 0.76 | 0.64 | 0.53 | 0.46 | 0.43 |

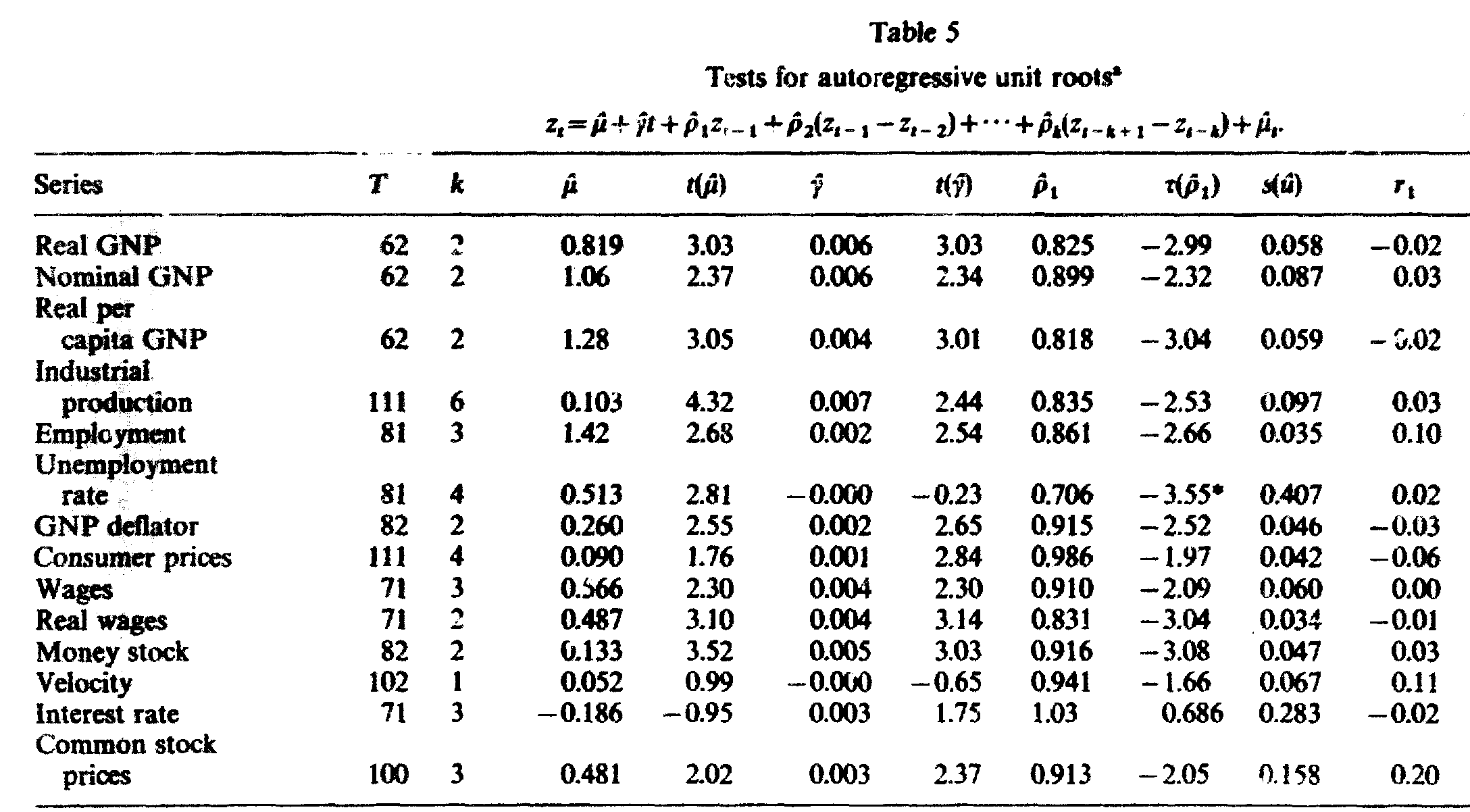

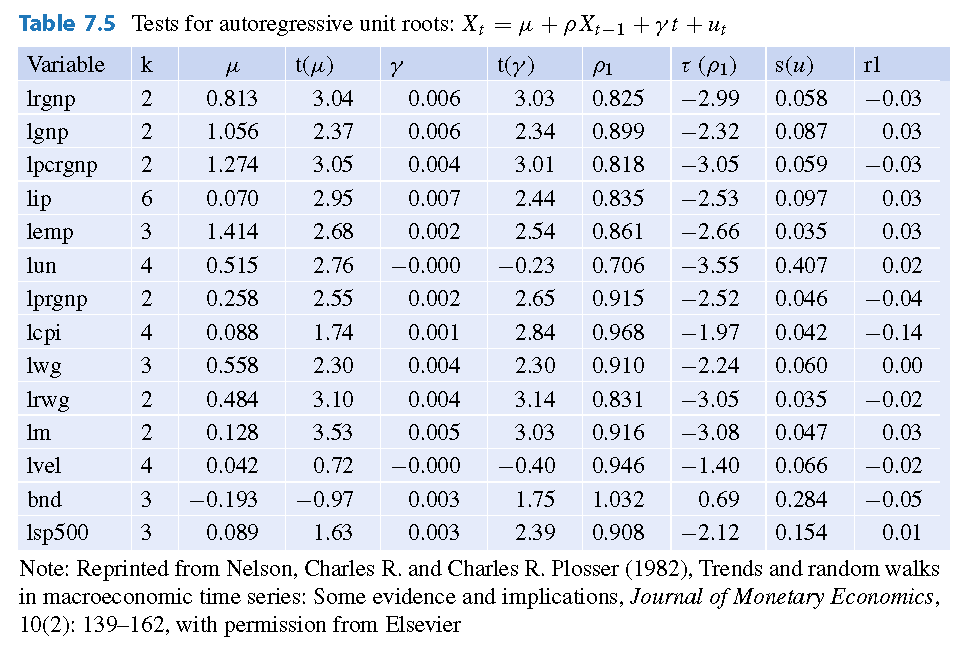

Estimar la regresión Dickey-Fuller, “a pie”#

Fuente: Nelson y Plosser 1982 Trends and Random Walks in Macroeconomic Time Series: Some evidence and implications. Journal of Monetary Economics 10, pp.139-162

Fuente: Levendis 2018 Time Series Econometrics: Learning Through Replication. Springer

def ADFregression(nombre_variable, k):

"""

Estima la regresión necesaria para la prueba aumentada de Dickey-Fuller

Args:

nombre_variable: str, nombre de una variable de la tabla "datos"

k: Número de rezagos del proceso AR subyacente (1 + rezagos en regresión)

Returns:

Un objeto de resultados estimados de statsmodels

"""

temp = datos[[nombre_variable]].dropna()

temp.columns=['Y']

temp['DY'] = temp['Y'].diff()

temp['LY'] = temp['Y'].shift()

temp['t'] = np.arange(temp.shape[0])

for j in range(1, k):

temp[f'D{j}Y'] = temp['DY'].shift(j)

regresores = ' + '.join(temp.columns[2:])

print(regresores)

frml = 'DY ~ ' + regresores

return ols(frml, temp).fit()

ADFregression('Real GNP', 4).summary()

LY + t + D1Y + D2Y + D3Y

| Dep. Variable: | DY | R-squared: | 0.265 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.194 |

| Method: | Least Squares | F-statistic: | 3.753 |

| Date: | Thu, 21 Jul 2022 | Prob (F-statistic): | 0.00563 |

| Time: | 00:34:55 | Log-Likelihood: | 84.601 |

| No. Observations: | 58 | AIC: | -157.2 |

| Df Residuals: | 52 | BIC: | -144.8 |

| Df Model: | 5 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 0.8645 | 0.317 | 2.723 | 0.009 | 0.227 | 1.501 |

| LY | -0.1880 | 0.070 | -2.687 | 0.010 | -0.328 | -0.048 |

| t | 0.0062 | 0.002 | 2.803 | 0.007 | 0.002 | 0.011 |

| D1Y | 0.3991 | 0.129 | 3.091 | 0.003 | 0.140 | 0.658 |

| D2Y | 0.0741 | 0.140 | 0.531 | 0.598 | -0.206 | 0.354 |

| D3Y | -0.0693 | 0.136 | -0.509 | 0.613 | -0.343 | 0.204 |

| Omnibus: | 3.110 | Durbin-Watson: | 2.010 |

|---|---|---|---|

| Prob(Omnibus): | 0.211 | Jarque-Bera (JB): | 2.243 |

| Skew: | -0.313 | Prob(JB): | 0.326 |

| Kurtosis: | 3.732 | Cond. No. | 1.57e+03 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.57e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

def NelsonPlosser(ser, k):

"""

Calcula varios estadísticos de la regresión de la prueba aumentada de Dickey-Fuller,

para reproducir los resultados reportados en la tabla 5 de Nelson y Plosser (1982)

Args:

ser: str, nombre abreviado de una variable de la tabla "datos"

k: Número de rezagos del proceso AR subyacente (1 + rezagos en regresión)

Returns:

dict, estadísticos calculados

"""

nombre_variable = variables[ser]

fuller5pct = -3.45

model = ADFregression(nombre_variable, k)

estadisticos = {

'mu': np.round(model.params['Intercept'], 3),

't(mu)': np.round(model.tvalues['Intercept'], 2),

'gamma': np.round(model.params['t'], 3),

't(gamma)': np.round(model.tvalues['t'], 2),

'rho': np.round(model.params['LY'] + 1, 3),

't(rho)': np.round(model.tvalues['LY'], 2),

's(u)': np.round(np.sqrt(model.mse_resid),3),

'r1': acf(model.resid, nlags=1, fft=False)[1].round(2),

'resultado': '* estacionaria' if model.tvalues['LY'] < fuller5pct else 'raiz unitaria'

}

return estadisticos

NelsonPlosser('lrgnp', 3)

LY + t + D1Y + D2Y

{'mu': 0.872,

't(mu)': 2.98,

'gamma': 0.006,

't(gamma)': 2.99,

'rho': 0.811,

't(rho)': -2.94,

's(u)': 0.059,

'r1': -0.01,

'resultado': 'raiz unitaria'}

rezagos = {'lrgnp':2, 'lgnp':2, 'lpcrgnp':2,'lip':6, 'lemp':3, 'lun':4, 'lprgnp':2, 'lcpi':4, 'lwg':3, 'lrwg':2, 'lm':2, 'lvel':4,'bnd':3,'lsp500':3}

tabla5 = pd.DataFrame([NelsonPlosser(ser, lags) for ser, lags in rezagos.items()], index=rezagos.keys())

tabla5

LY + t + D1Y

LY + t + D1Y

LY + t + D1Y

LY + t + D1Y + D2Y + D3Y + D4Y + D5Y

LY + t + D1Y + D2Y

LY + t + D1Y + D2Y + D3Y

LY + t + D1Y

LY + t + D1Y + D2Y + D3Y

LY + t + D1Y + D2Y

LY + t + D1Y

LY + t + D1Y

LY + t + D1Y + D2Y + D3Y

LY + t + D1Y + D2Y

LY + t + D1Y + D2Y

| mu | t(mu) | gamma | t(gamma) | rho | t(rho) | s(u) | r1 | resultado | |

|---|---|---|---|---|---|---|---|---|---|

| lrgnp | 0.813 | 3.04 | 0.006 | 3.03 | 0.825 | -2.99 | 0.058 | -0.03 | raiz unitaria |

| lgnp | 1.056 | 2.37 | 0.006 | 2.34 | 0.899 | -2.32 | 0.087 | 0.03 | raiz unitaria |

| lpcrgnp | 1.274 | 3.05 | 0.004 | 3.01 | 0.818 | -3.05 | 0.059 | -0.03 | raiz unitaria |

| lip | 0.070 | 2.95 | 0.007 | 2.44 | 0.835 | -2.53 | 0.097 | 0.03 | raiz unitaria |

| lemp | 1.414 | 2.68 | 0.002 | 2.54 | 0.861 | -2.66 | 0.035 | 0.03 | raiz unitaria |

| lun | 0.515 | 2.76 | -0.000 | -0.23 | 0.706 | -3.55 | 0.407 | 0.02 | * estacionaria |

| lprgnp | 0.258 | 2.55 | 0.002 | 2.65 | 0.915 | -2.52 | 0.046 | -0.04 | raiz unitaria |

| lcpi | 0.088 | 1.74 | 0.001 | 2.84 | 0.968 | -1.97 | 0.042 | -0.14 | raiz unitaria |

| lwg | 0.558 | 2.30 | 0.004 | 2.30 | 0.910 | -2.24 | 0.060 | 0.00 | raiz unitaria |

| lrwg | 0.484 | 3.10 | 0.004 | 3.14 | 0.831 | -3.05 | 0.035 | -0.02 | raiz unitaria |

| lm | 0.128 | 3.53 | 0.005 | 3.03 | 0.916 | -3.08 | 0.047 | 0.03 | raiz unitaria |

| lvel | 0.042 | 0.72 | -0.000 | -0.40 | 0.946 | -1.40 | 0.066 | -0.02 | raiz unitaria |

| bnd | -0.193 | -0.97 | 0.003 | 1.75 | 1.032 | 0.69 | 0.284 | -0.05 | raiz unitaria |

| lsp500 | 0.089 | 1.63 | 0.003 | 2.39 | 0.908 | -2.12 | 0.154 | 0.01 | raiz unitaria |

NOTA: Una versión anterior de este archivo tenía la réplica del trabajo de KPSS. Ese código ahora está en el cuaderno KPSS.ipynb.