Estimación de un VAR de la política monetaria de Costa Rica

Contents

8.3. Estimación de un VAR de la política monetaria de Costa Rica#

Primeros pasos#

Nota Para ejecutar este cuaderno se requiere el paquete bccr. Si no lo tiene, ejecute la siguiente celda

try:

import bccr

except ImportError:

print('Module bccr missing. Installing it now')

!pip install bccr

from bccr import SW

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

plt.style.use('seaborn')

from statsmodels.tsa.api import VAR

plt.rc('font', serif=['Computer Modern'])

Descargar datos#

SW.buscar('desempleo abierto', periodo='Trimestral')

| DESCRIPCION | Unidad | Medida | periodo | |

|---|---|---|---|---|

| codigo | ||||

| 22796 | Demográficas y Mercado Laboral/Tasa de desempleo abierto [22796]' | Porcentaje | Unidades | Trimestral |

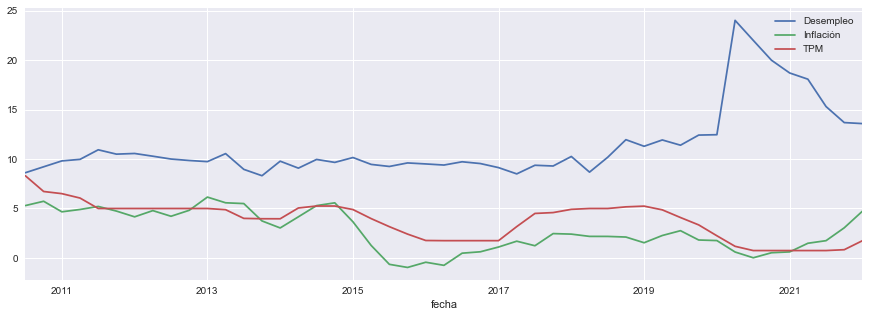

datos = SW(Desempleo=22796, Inflación=25485, TPM=3541, FechaInicio=2010, func=np.mean, fillna='ffill').dropna()

datos.plot(figsize=[15,5])

<AxesSubplot:xlabel='fecha'>

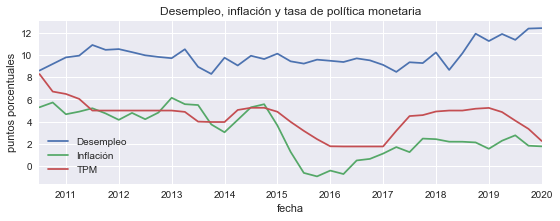

Importante Por fines didácticos, ahora restringimos la muestra a datos hasta el primer trimestre de 2020. El gran aumento en la tasa de desempleo que siguió al impacto de la pandemia del COVID no se ve reflejado en las otras variables del modelo. Como ejercicio, estime y analice este mismo VAR con datos hasta el segundo trimestre del 2020 (cambiando la siguiente celda); verá que en ese caso el VAR estimado resulta inestable!!

datos = datos[:'2020Q1']

Graficar los datos utilizados#

fig, ax = plt.subplots(figsize=[9,3])

datos.plot(ax=ax)

ax.set(title='Desempleo, inflación y tasa de política monetaria', ylabel='puntos porcentuales');

#fig.savefig('VAR-variables.pdf', bbox_inches='tight')

Estimar un VAR#

model = VAR(datos)

res = model.fit(4, ic='bic')

res.summary()

Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Thu, 21, Jul, 2022

Time: 00:20:23

--------------------------------------------------------------------

No. of Equations: 3.00000 BIC: -1.30856

Nobs: 38.0000 HQIC: -1.64170

Log likelihood: -115.071 FPE: 0.161485

AIC: -1.82569 Det(Omega_mle): 0.119601

--------------------------------------------------------------------

Results for equation Desempleo

===============================================================================

coefficient std. error t-stat prob

-------------------------------------------------------------------------------

const 2.305139 1.265376 1.822 0.069

L1.Desempleo 0.708084 0.125437 5.645 0.000

L1.Inflación -0.127880 0.087455 -1.462 0.144

L1.TPM 0.243191 0.124252 1.957 0.050

===============================================================================

Results for equation Inflación

===============================================================================

coefficient std. error t-stat prob

-------------------------------------------------------------------------------

const -0.062525 1.588872 -0.039 0.969

L1.Desempleo -0.003928 0.157505 -0.025 0.980

L1.Inflación 0.827925 0.109813 7.539 0.000

L1.TPM 0.119255 0.156017 0.764 0.445

===============================================================================

Results for equation TPM

===============================================================================

coefficient std. error t-stat prob

-------------------------------------------------------------------------------

const 2.282890 0.964744 2.366 0.018

L1.Desempleo -0.164187 0.095635 -1.717 0.086

L1.Inflación 0.091391 0.066677 1.371 0.170

L1.TPM 0.753419 0.094732 7.953 0.000

===============================================================================

Correlation matrix of residuals

Desempleo Inflación TPM

Desempleo 1.000000 -0.031396 -0.003364

Inflación -0.031396 1.000000 0.307269

TPM -0.003364 0.307269 1.000000

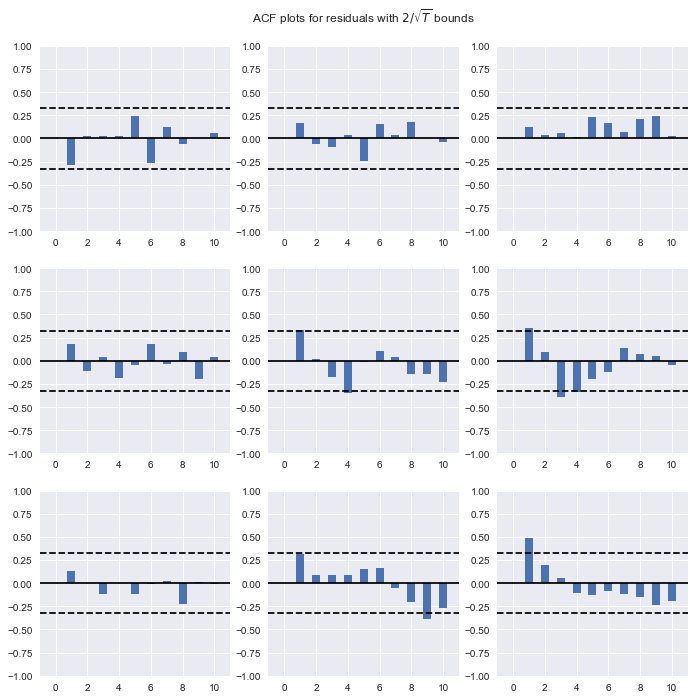

Autocorrelograma de los residuos

res.plot_acorr();

Número óptimo de rezagos para el VAR#

temp = model.select_order(4).summary()

temp

| AIC | BIC | FPE | HQIC | |

|---|---|---|---|---|

| 0 | 1.227 | 1.360 | 3.411 | 1.273 |

| 1 | -1.779 | -1.246* | 0.1693 | -1.595 |

| 2 | -2.121* | -1.188 | 0.1219* | -1.799* |

| 3 | -2.007 | -0.6741 | 0.1411 | -1.547 |

| 4 | -2.002 | -0.2689 | 0.1511 | -1.404 |

Exportar esta tabla a LaTeX

with open('VAR-ic.tex','w') as archivo:

archivo.write(temp.as_latex_tabular())

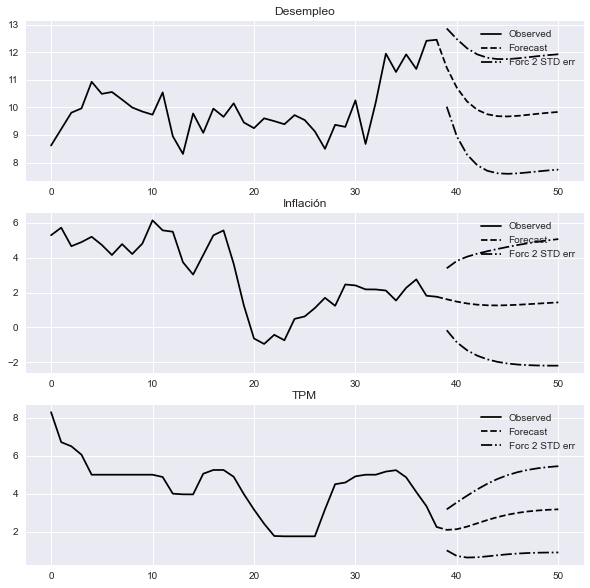

Pronosticar las variables#

fig = res.plot_forecast(12);

#fig.savefig('VAR-forecast.pdf', bbox_inches='tight')

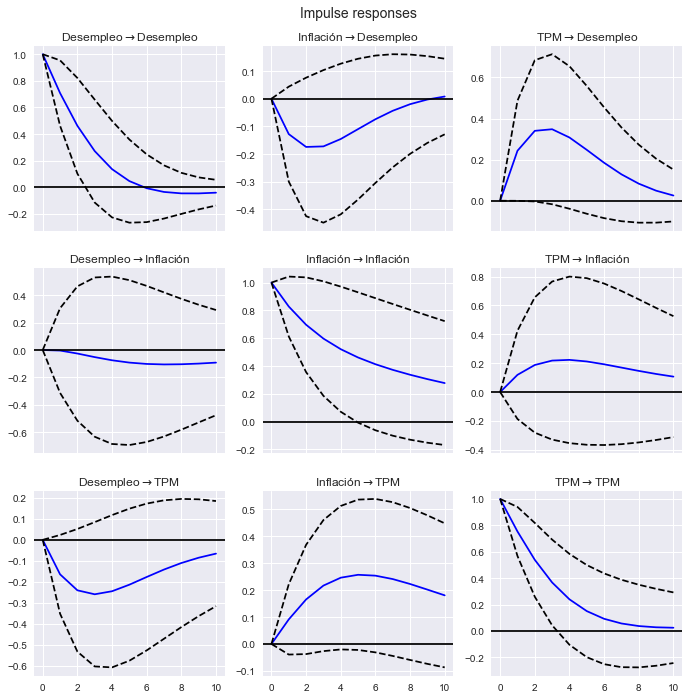

Analizar las funciones de impulso respuesta#

fig = res.irf(10).plot(subplot_params={'figsize':[12,4]});

#fig.savefig('VAR-irf-1.pdf', bbox_inches='tight')

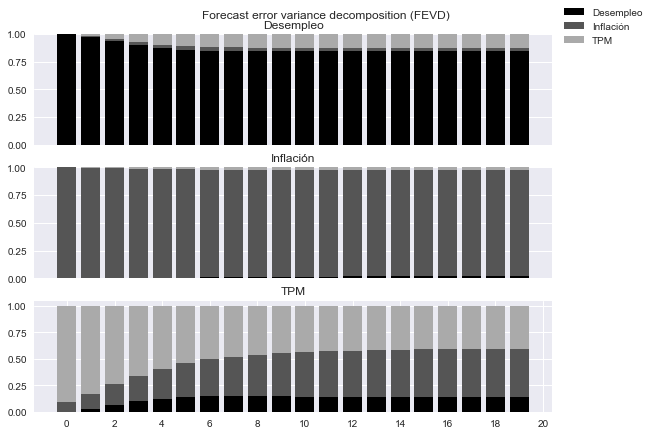

Analizar la descomposición de varianza#

fig=res.fevd(20).plot(figsize=[9,6]);

fig.axes[0].set(xticks=[])

fig.axes[1].set(xticks=[])

fig.axes[2].set(xticks=np.arange(0,21,2))

for ax in fig.axes:

ax.set(yticks=[0,0.25,0.5,0.75,1.0])

#fig.savefig('VAR-fevd.pdf', bbox_inches='tight')

Estudiar la causalidad de Granger#

granger = pd.DataFrame(np.zeros([3,3]), index = datos.columns.values, columns=datos.columns.values)

for i in datos.columns:

for j in datos.columns:

temp = res.test_causality(i, j)

print(temp.summary())

granger.loc[j, i] = np.round(temp.pvalue,3)

Granger causality F-test. H_0: Desempleo does not Granger-cause Desempleo. Conclusion: reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

31.87 3.934 0.000 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: Inflación does not Granger-cause Desempleo. Conclusion: fail to reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

2.138 3.934 0.147 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: TPM does not Granger-cause Desempleo. Conclusion: fail to reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

3.831 3.934 0.053 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: Desempleo does not Granger-cause Inflación. Conclusion: fail to reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

0.0006220 3.934 0.980 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: Inflación does not Granger-cause Inflación. Conclusion: reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

56.84 3.934 0.000 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: TPM does not Granger-cause Inflación. Conclusion: fail to reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

0.5843 3.934 0.446 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: Desempleo does not Granger-cause TPM. Conclusion: fail to reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

2.947 3.934 0.089 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: Inflación does not Granger-cause TPM. Conclusion: fail to reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

1.879 3.934 0.173 (1, 102)

----------------------------------------------

Granger causality F-test. H_0: TPM does not Granger-cause TPM. Conclusion: reject H_0 at 5% significance level.

==============================================

Test statistic Critical value p-value df

----------------------------------------------

63.25 3.934 0.000 (1, 102)

----------------------------------------------

granger.index.name = 'Explicativa'

granger.columns.name = 'Dependiente'

granger

| Dependiente | Desempleo | Inflación | TPM |

|---|---|---|---|

| Explicativa | |||

| Desempleo | 0.000 | 0.980 | 0.089 |

| Inflación | 0.147 | 0.000 | 0.173 |

| TPM | 0.053 | 0.446 | 0.000 |

granger.to_latex('VAR-Granger-causality.tex', escape=False)

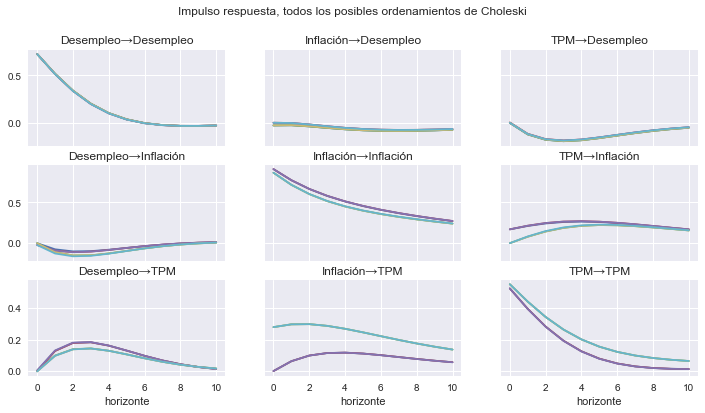

¿Qué tan sensibles son los resultados al ordenamiento de las variables? Estimando todas las combinaciones#

from itertools import permutations

ordenamientos = [x for x in permutations(datos.columns)]

def chol_irf(orden, h=10):

res = VAR(datos[[*orden]]).fit(1)

irf = res.irf(h).orth_irfs.flatten()

idx = pd.MultiIndex.from_product([np.arange(h+1),orden, orden])

return pd.DataFrame({'→'.join(orden): irf}, index=idx)

irfs = pd.concat([chol_irf(A) for A in ordenamientos], axis=1)

irfs = irfs.stack().unstack(level=[2,1,3])

irfs

| Desempleo | Inflación | TPM | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Desempleo | Desempleo | ... | TPM | TPM | |||||||||||||||||

| Desempleo→Inflación→TPM | Desempleo→TPM→Inflación | Inflación→Desempleo→TPM | Inflación→TPM→Desempleo | TPM→Desempleo→Inflación | TPM→Inflación→Desempleo | Desempleo→Inflación→TPM | Desempleo→TPM→Inflación | Inflación→Desempleo→TPM | Inflación→TPM→Desempleo | ... | Inflación→Desempleo→TPM | Inflación→TPM→Desempleo | TPM→Desempleo→Inflación | TPM→Inflación→Desempleo | Desempleo→Inflación→TPM | Desempleo→TPM→Inflación | Inflación→Desempleo→TPM | Inflación→TPM→Desempleo | TPM→Desempleo→Inflación | TPM→Inflación→Desempleo | |

| 0 | 0.724194 | 0.724194 | 0.723837 | 0.723821 | 0.724189 | 0.723821 | 0.000000 | 0.000000 | -0.022736 | -0.022736 | ... | 0.169655 | 0.169655 | 0.000000 | 0.000000 | 0.525415 | 0.552134 | 0.525415 | 0.525427 | 0.552138 | 0.552138 |

| 1 | 0.515989 | 0.515989 | 0.513381 | 0.512526 | 0.516317 | 0.512526 | -0.074963 | -0.110604 | -0.091126 | -0.091126 | ... | 0.214659 | 0.214659 | 0.079044 | 0.082878 | 0.395858 | 0.441516 | 0.395858 | 0.395082 | 0.441927 | 0.441927 |

| 2 | 0.338887 | 0.338887 | 0.335561 | 0.334373 | 0.339353 | 0.334373 | -0.100606 | -0.150665 | -0.111196 | -0.111196 | ... | 0.247351 | 0.247351 | 0.143155 | 0.148781 | 0.282994 | 0.343617 | 0.282994 | 0.281851 | 0.344219 | 0.344219 |

| 3 | 0.201204 | 0.201204 | 0.198044 | 0.196832 | 0.201687 | 0.196832 | -0.097494 | -0.148945 | -0.103762 | -0.103762 | ... | 0.265491 | 0.265491 | 0.187676 | 0.193762 | 0.192877 | 0.263295 | 0.192877 | 0.191642 | 0.263948 | 0.263948 |

| 4 | 0.102158 | 0.102158 | 0.099593 | 0.098523 | 0.102592 | 0.098523 | -0.080090 | -0.125896 | -0.083258 | -0.083258 | ... | 0.270198 | 0.270198 | 0.213072 | 0.218835 | 0.125788 | 0.200995 | 0.125788 | 0.124620 | 0.201615 | 0.201615 |

| 5 | 0.036303 | 0.036303 | 0.034470 | 0.033610 | 0.036659 | 0.033610 | -0.057790 | -0.094966 | -0.058901 | -0.058901 | ... | 0.264165 | 0.264165 | 0.222396 | 0.227443 | 0.078941 | 0.154777 | 0.078941 | 0.077921 | 0.155321 | 0.155321 |

| 6 | -0.003536 | -0.003536 | -0.004668 | -0.005309 | -0.003263 | -0.005309 | -0.036115 | -0.064193 | -0.035986 | -0.035986 | ... | 0.250521 | 0.250521 | 0.219621 | 0.223820 | 0.048302 | 0.121683 | 0.048302 | 0.047457 | 0.122138 | 0.122138 |

| 7 | -0.024506 | -0.024506 | -0.025054 | -0.025500 | -0.024308 | -0.025500 | -0.017845 | -0.037735 | -0.017067 | -0.017067 | ... | 0.232183 | 0.232183 | 0.208660 | 0.212032 | 0.029701 | 0.098596 | 0.029701 | 0.029025 | 0.098964 | 0.098964 |

| 8 | -0.032811 | -0.032811 | -0.032919 | -0.033207 | -0.032675 | -0.033207 | -0.003965 | -0.017186 | -0.002933 | -0.002933 | ... | 0.211546 | 0.211546 | 0.192856 | 0.195503 | 0.019434 | 0.082704 | 0.019434 | 0.018907 | 0.082993 | 0.082993 |

| 9 | -0.033352 | -0.033352 | -0.033159 | -0.033329 | -0.033263 | -0.033329 | 0.005604 | -0.002588 | 0.006649 | 0.006649 | ... | 0.190395 | 0.190395 | 0.174794 | 0.176848 | 0.014518 | 0.071705 | 0.014518 | 0.014112 | 0.071932 | 0.071932 |

| 10 | -0.029709 | -0.029709 | -0.029334 | -0.029421 | -0.029654 | -0.029421 | 0.011486 | 0.006828 | 0.012413 | 0.012413 | ... | 0.169940 | 0.169940 | 0.156308 | 0.157902 | 0.012733 | 0.063860 | 0.012733 | 0.012420 | 0.064036 | 0.064036 |

11 rows × 54 columns

fig, axs = plt.subplots(3,3, figsize=[12,6], sharex=True, sharey='row')

for i, impulso in enumerate(datos.columns):

for j, respuesta in enumerate(datos.columns):

irfs[impulso][respuesta].plot(ax=axs[i,j], legend=False)

axs[j,i].set_title(impulso + '→' + respuesta )

for ax in axs[-1]:

ax.set_xlabel('horizonte')

fig.suptitle('Impulso respuesta, todos los posibles ordenamientos de Choleski')

#fig.savefig('VAR-irf-all-orderings.pdf', bbox_inches='tight')

Text(0.5, 0.98, 'Impulso respuesta, todos los posibles ordenamientos de Choleski')