Estimación de la demanda de dinero

3.2. Estimación de la demanda de dinero#

Nota Para ejecutar este cuaderno se requiere el paquete bccr. Si no lo tiene, ejecute la siguiente celda

try:

import bccr

except ImportError:

print('Module bccr missing. Installing it now')

!pip install bccr

from bccr import SW

import numpy as np

from matplotlib import rcParams

import matplotlib.pyplot as plt

plt.style.use('seaborn')

import matplotlib.gridspec as gridspec

import statsmodels.api as sm

from statsmodels.formula.api import ols

plt.style.use('seaborn')

# Cambiar tamaño de las fuentes

rcParams['axes.titlesize'] = 20

rcParams['axes.labelsize'] = 16

rcParams['xtick.labelsize'] = 14

rcParams['ytick.labelsize'] = 14

SW.buscar('medio circulante')

| DESCRIPCION | Unidad | Medida | periodo | |

|---|---|---|---|---|

| codigo | ||||

| 608 | Sector Monetario y Financiero/Medio circulante [608]' | Colón Costarricense | NaN | Mensual |

SW.buscar('tasa básica pasiva', frecuencia='D')

| DESCRIPCION | Unidad | Medida | periodo | |

|---|---|---|---|---|

| codigo | ||||

| 3748 | Tasas de interés/Tasa básica pasiva [3748]' | Porcentaje | NaN | Diaria |

variables = dict(IMAE=35449,IPC=25482,M1=1445,Tbasica=423)

datos = SW(**variables, func='mean', FechaInicio='1991m01', FechaFinal='2020m11').dropna()

datos

| IMAE | IPC | M1 | Tbasica | |

|---|---|---|---|---|

| fecha | ||||

| 1991-01 | 51.108817 | 8.064069 | 6.158123e+04 | 34.000000 |

| 1991-02 | 42.665858 | 8.301969 | 6.024168e+04 | 35.000000 |

| 1991-03 | 40.391637 | 8.407419 | 5.942290e+04 | 33.193548 |

| 1991-04 | 40.185649 | 8.644489 | 6.078601e+04 | 33.000000 |

| 1991-05 | 40.276545 | 8.794029 | 6.185368e+04 | 32.500000 |

| ... | ... | ... | ... | ... |

| 2020-07 | 110.987099 | 106.127077 | 5.166828e+06 | 3.708065 |

| 2020-08 | 110.584336 | 106.122788 | 5.206881e+06 | 3.635484 |

| 2020-09 | 113.705524 | 106.411930 | 5.206211e+06 | 3.498333 |

| 2020-10 | 118.613059 | 106.496597 | 5.061595e+06 | 3.293548 |

| 2020-11 | 120.969090 | 106.498184 | 4.913216e+06 | 3.346667 |

359 rows × 4 columns

res = ols('M1 ~ IMAE + IPC + Tbasica', data=np.log(datos)).fit()

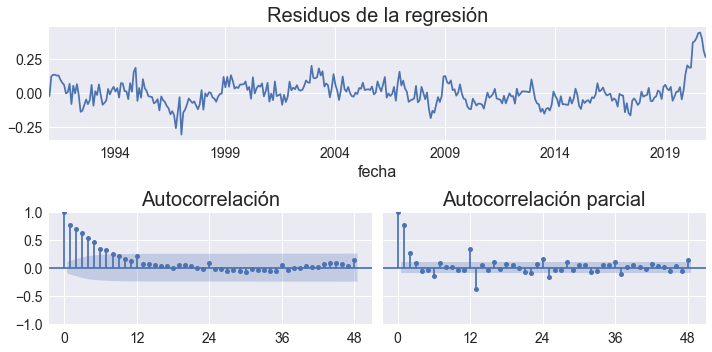

fig = plt.figure(figsize=[10,5], tight_layout=True)

gs = gridspec.GridSpec(2, 2)

ax = fig.add_subplot(gs[0, :])

axs0 = fig.add_subplot(gs[1,0])

axs1 = fig.add_subplot(gs[1,1], sharey=axs0)

res.resid.plot(title='Residuos de la regresión', ax=ax)

OPCIONES = dict(lags=48, alpha=0.05, )

sm.graphics.tsa.plot_acf(res.resid, ax=axs0, title='Autocorrelación',**OPCIONES);

sm.graphics.tsa.plot_pacf(res.resid, ax=axs1, title='Autocorrelación parcial', **OPCIONES);

axs0.set_xticks([0,12,24,36,48])

axs1.set_xticks([0,12,24,36,48])

fig.savefig('residuos-demanda-dinero.pdf', bbox_inches='tight')

sss = res.summary()

sss

| Dep. Variable: | M1 | R-squared: | 0.994 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.994 |

| Method: | Least Squares | F-statistic: | 1.944e+04 |

| Date: | Thu, 21 Jul 2022 | Prob (F-statistic): | 0.00 |

| Time: | 00:15:30 | Log-Likelihood: | 335.36 |

| No. Observations: | 359 | AIC: | -662.7 |

| Df Residuals: | 355 | BIC: | -647.2 |

| Df Model: | 3 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| Intercept | 6.3294 | 0.298 | 21.263 | 0.000 | 5.744 | 6.915 |

| IMAE | 1.0242 | 0.079 | 13.044 | 0.000 | 0.870 | 1.179 |

| IPC | 0.9268 | 0.028 | 33.508 | 0.000 | 0.872 | 0.981 |

| Tbasica | -0.3519 | 0.022 | -15.919 | 0.000 | -0.395 | -0.308 |

| Omnibus: | 115.244 | Durbin-Watson: | 0.450 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 463.868 |

| Skew: | 1.349 | Prob(JB): | 1.87e-101 |

| Kurtosis: | 7.872 | Cond. No. | 390. |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

sss.tables[2]

| Omnibus: | 115.244 | Durbin-Watson: | 0.450 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 463.868 |

| Skew: | 1.349 | Prob(JB): | 1.87e-101 |

| Kurtosis: | 7.872 | Cond. No. | 390. |

sss = res.summary()

with open('regresion-M1.tex','w') as file:

file.write(sss.tables[1].as_latex_tabular())

file.write(sss.tables[2].as_latex_tabular())